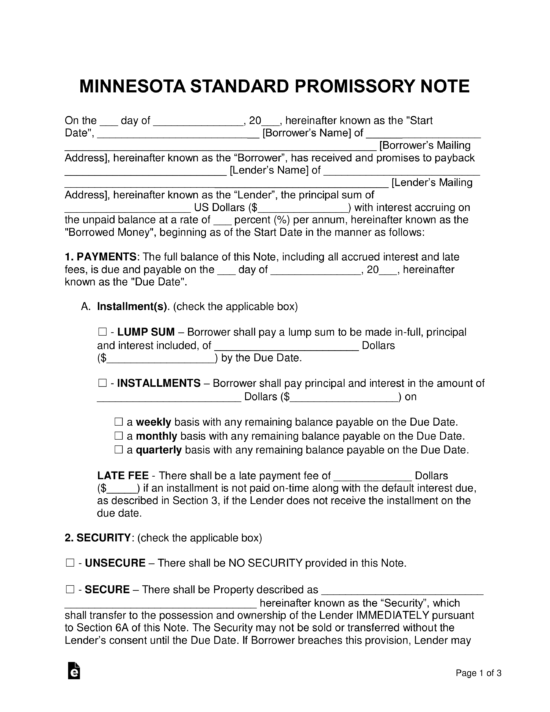

Promissory Note Template Minnesota - _______________, with a mailing address of ______________________________, (“borrower”), and lender: Web updated april 11, 2022. Web the promissory note template for minnesota is easy to follow. Opening information, like the date, the name and address of both the borrower and lender, the total of the loan and the interest rate; See below, “what should be in a promissory note?” promissory notes are used for personal loans, business loans and real estate transactions. Web this promissory note (the “note”) is made as of this ______________ (mm/dd/yyyy), hereinafter known as the “start date,” by and between: This note shall be governed under the laws in the state of minnesota. The template helps to ensure that the lender of the balance is reimbursed the full amount of the note plus accumulated interest. When you write a secured promissory note, you’ll include: Use the links near the top of the page to download the minnesota unsecured promissory note template.

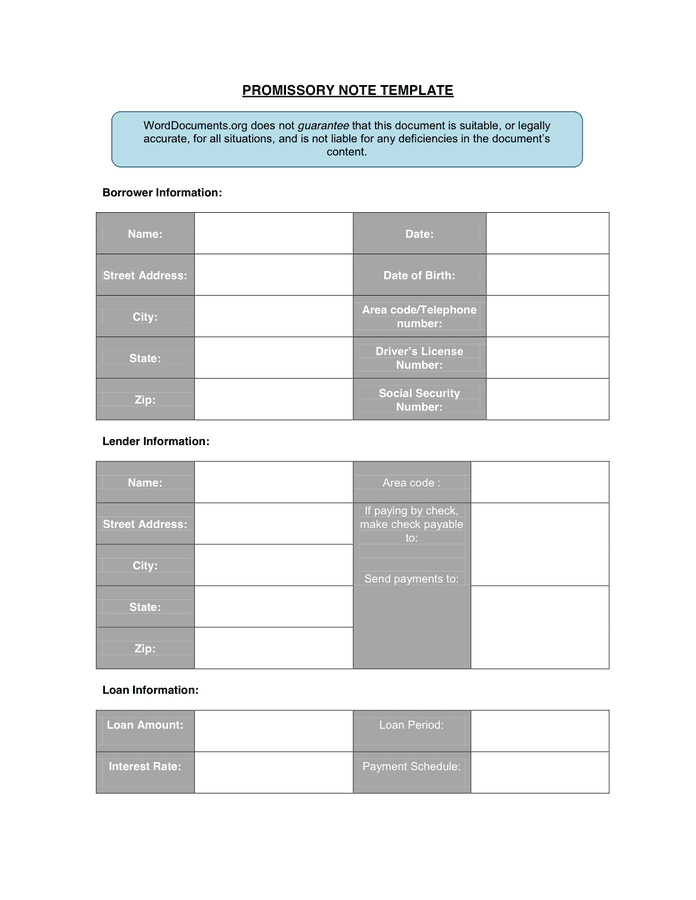

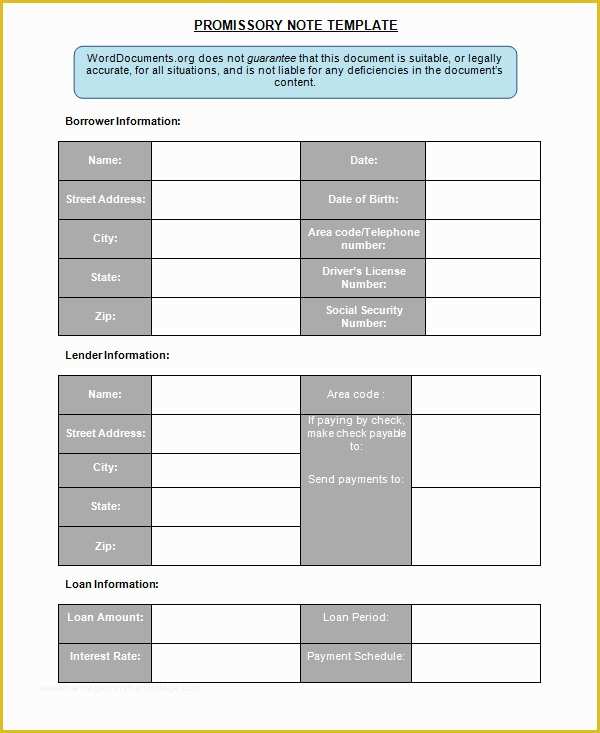

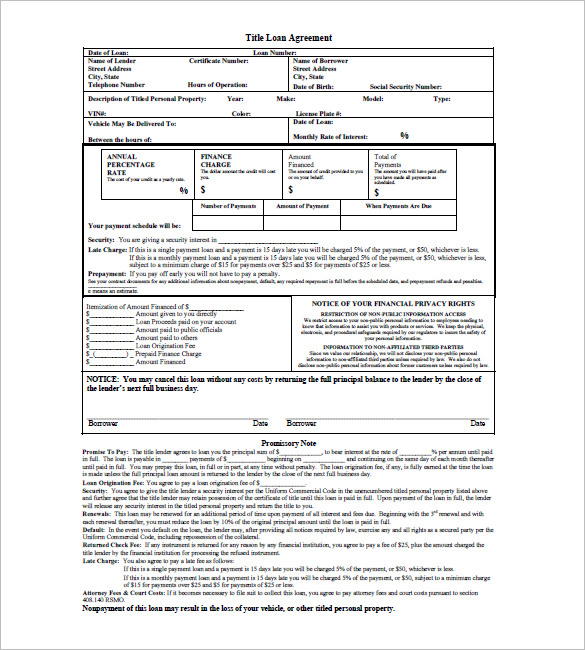

Promissory Note Template in Word and Pdf formats

When you write a secured promissory note, you’ll include: Web this promissory note (the “note”) is made as of this ______________ (mm/dd/yyyy), hereinafter known as the “start date,” by and between: Web updated april 25, 2023. A minnesota promissory note can be unsecured or secured; Web unsecured promissory note the parties.

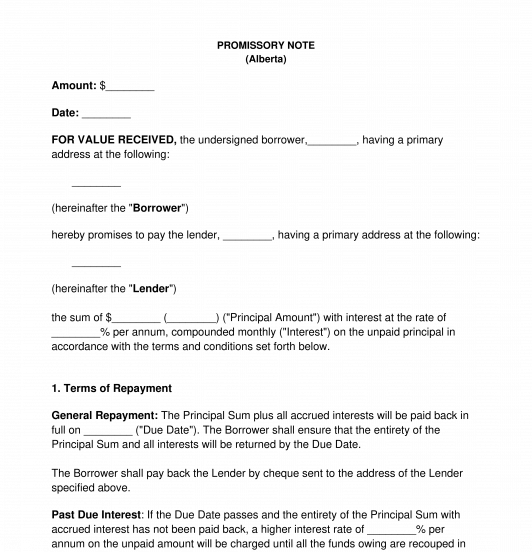

Promissory Note meaning, format, example, types, features

This minnesota unsecured standard promissory note (“note”) made on _______________, 20____ is by and between: Interest due in case the borrower evades the note or loan; Web updated april 11, 2022. Use the links near the top of the page to download the minnesota unsecured promissory note template. Web minnesota promissory note templates.

Promissory Note Sample, Template Word & PDF

Unsecured notes, in contrast to secured ones, do not require that the borrower. Web minnesota promissory note templates. A minnesota promissory note template is used for transactions involving the lending of a monetary balance between two parties. Interest due in case the borrower evades the note or loan; Web updated april 11, 2022.

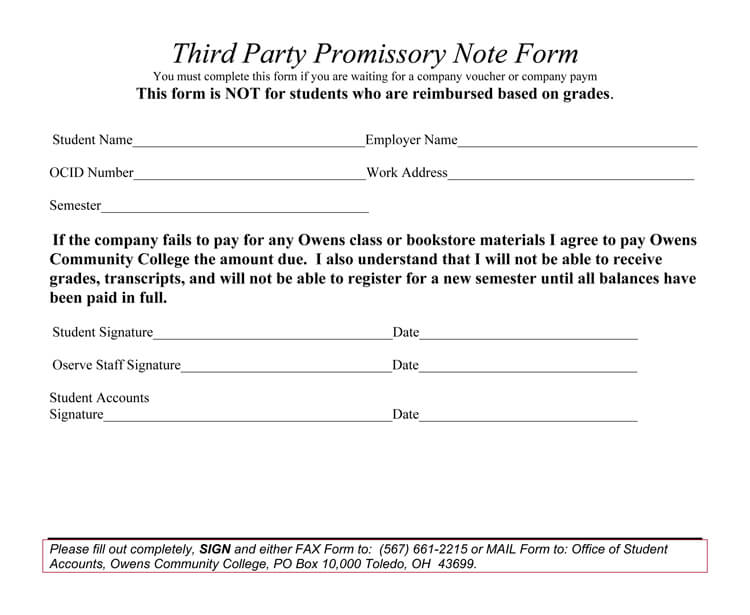

Promissory Note Example For School Payment

Promissory notes in minnesota are regulated by contract and securities law. This note shall be governed under the laws in the state of minnesota. Opening information, like the date, the name and address of both the borrower and lender, the total of the loan and the interest rate; When you write a secured promissory note, you’ll include: A minnesota promissory.

Promissory Note Free Template Download Of Promissory Note 26 Download

Web unsecured promissory note the parties. Web the promissory note template for minnesota is easy to follow. A minnesota unsecured promissory note organizes and solidifies the important aspects of a loan agreement between two parties. The template helps to ensure that the lender of the balance is reimbursed the full amount of the note plus accumulated interest. A minnesota promissory.

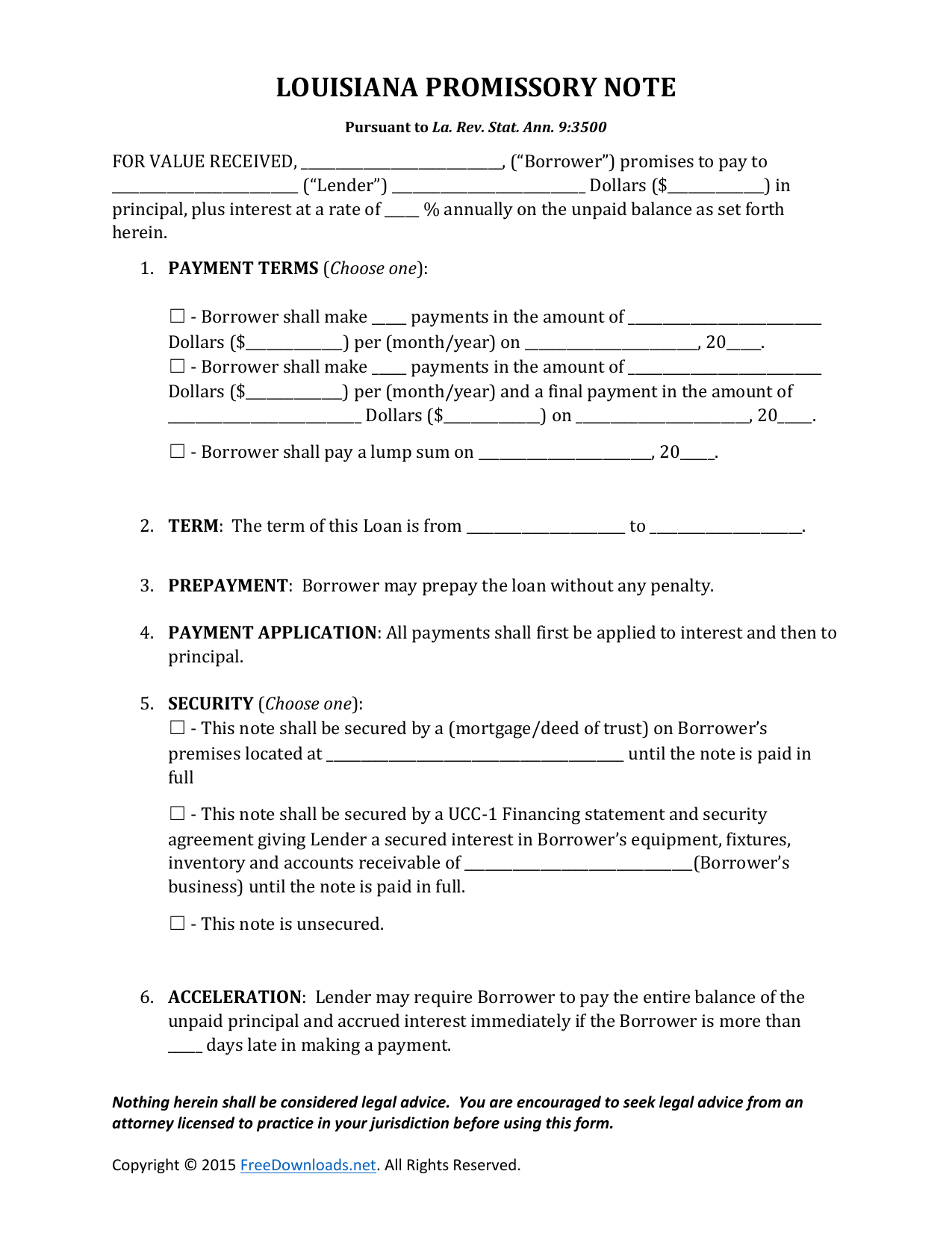

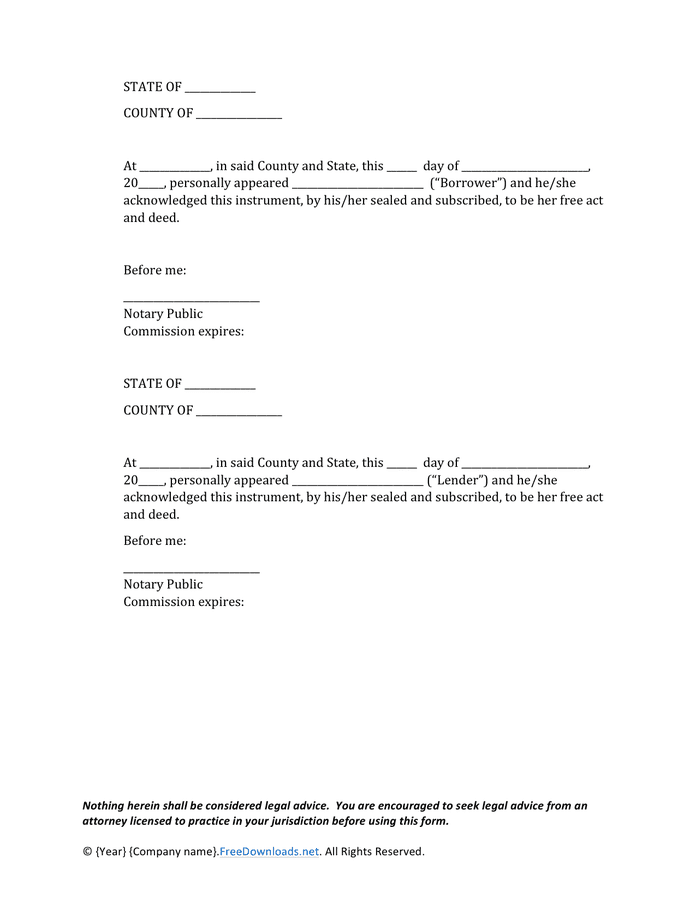

Download Louisiana Promissory Note Form PDF RTF Word

The borrower executes this note as a principal and not as a surety. The template helps to ensure that the lender of the balance is reimbursed the full amount of the note plus accumulated interest. This minnesota unsecured standard promissory note (“note”) made on _______________, 20____ is by and between: Web if the promissory note is done right, it is.

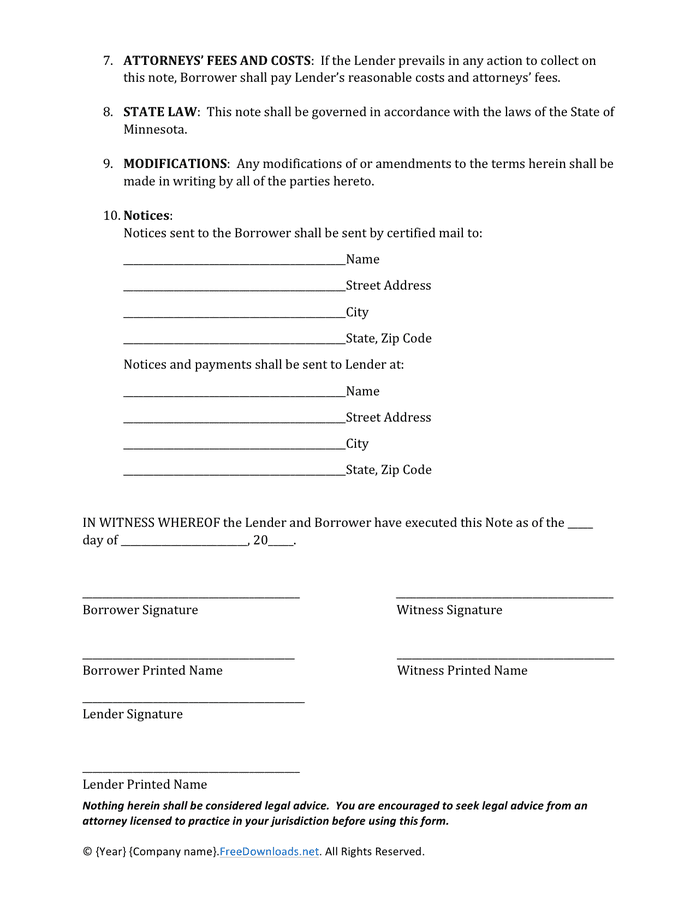

Promissory note template (Minnesota) in Word and Pdf formats page 3 of 3

Interest due in case the borrower evades the note or loan; Web unsecured promissory note the parties. Web a sample minnesota promissory note with examples for each step. Web this promissory note (the “note”) is made as of this ______________ (mm/dd/yyyy), hereinafter known as the “start date,” by and between: _______________, with a mailing address of ______________________________, (“borrower”), and lender:

Free Minnesota Promissory Note Templates (2) Word PDF eForms

Use the links near the top of the page to download the minnesota unsecured promissory note template. ________________________ (borrower name) of ___________________________________ (the “borrower”) has received and promises to payback Web updated april 11, 2022. Interest due in case the borrower evades the note or loan; Web terms of this note.

Promissory note template (Minnesota) in Word and Pdf formats page 2 of 3

_______________, with a mailing address of ______________________________, (“borrower”), and lender: Web unsecured promissory note the parties. The document covers payment types, late fees, both parties’ personal info, acceleration time spans, and many other important terms and conditions. Web terms of this note. Opening information, like the date, the name and address of both the borrower and lender, the total of.

Loan Promissory Note 10+ Free Word, Excel, PDF Format Download Free

Web terms of this note. The template helps to ensure that the lender of the balance is reimbursed the full amount of the note plus accumulated interest. Promissory notes in minnesota are regulated by contract and securities law. See below, “what should be in a promissory note?” promissory notes are used for personal loans, business loans and real estate transactions..

A minnesota promissory note can be unsecured or secured; Web the promissory note template for minnesota is easy to follow. ________________________ (borrower name) of ___________________________________ (the “borrower”) has received and promises to payback Web minnesota promissory note templates. Use the links near the top of the page to download the minnesota unsecured promissory note template. This minnesota unsecured standard promissory note (“note”) made on _______________, 20____ is by and between: The template helps to ensure that the lender of the balance is reimbursed the full amount of the note plus accumulated interest. Interest due in case the borrower evades the note or loan; The borrower executes this note as a principal and not as a surety. Web if the promissory note is done right, it is legal and a court can enforce it. Web unsecured promissory note the parties. Web minnesota unsecured promissory note template. Web terms of this note. Promissory notes in minnesota are regulated by contract and securities law. The minnesota promissory note templates serve as written agreements that are used to outline the principal sum, interest rate, borrower/lender, repayment schedule/frequency, and other terms of a loan. See below, “what should be in a promissory note?” promissory notes are used for personal loans, business loans and real estate transactions. Unsecured notes, in contrast to secured ones, do not require that the borrower. Web updated april 11, 2022. Web updated april 25, 2023. Web a sample minnesota promissory note with examples for each step.

When You Write A Secured Promissory Note, You’ll Include:

Web the promissory note template for minnesota is easy to follow. The borrower executes this note as a principal and not as a surety. Web minnesota unsecured promissory note template. Web a sample minnesota promissory note with examples for each step.

Web If The Promissory Note Is Done Right, It Is Legal And A Court Can Enforce It.

See below, “what should be in a promissory note?” promissory notes are used for personal loans, business loans and real estate transactions. A minnesota promissory note template is used for transactions involving the lending of a monetary balance between two parties. Promissory notes in minnesota are regulated by contract and securities law. Unsecured notes, in contrast to secured ones, do not require that the borrower.

The Template Is Designed To Be Used When Drafting An Unsecured Promissory Note (For Use In The State Of Minnesota).

A minnesota promissory note can be unsecured or secured; Web minnesota promissory note templates. A minnesota unsecured promissory note organizes and solidifies the important aspects of a loan agreement between two parties. Interest due in case the borrower evades the note or loan;

Web Updated April 11, 2022.

Web unsecured promissory note the parties. The template helps to ensure that the lender of the balance is reimbursed the full amount of the note plus accumulated interest. Opening information, like the date, the name and address of both the borrower and lender, the total of the loan and the interest rate; _______________, with a mailing address of ______________________________, (“borrower”), and lender: