Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - This means you need to keep accurate records of your deductions as well as your earnings. Decide on what kind of signature to create. Download 2023 per diem tracker Schedule a:various medical expenses, charitable contributions, unreimbursed employee business expenses, etc. However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Type text, add images, blackout confidential details,. Get helpful information for truck driver taxes, deductions, truck depreciation, and tips for minimizing taxes. Keep track of what deductions you are taking advantage of. Web most truck driver pay about $550 dollar for heavy highway use tax. Trucker’s income & expense worksheet;

Truck Expenses Worksheet Spreadsheet template, Printable worksheets

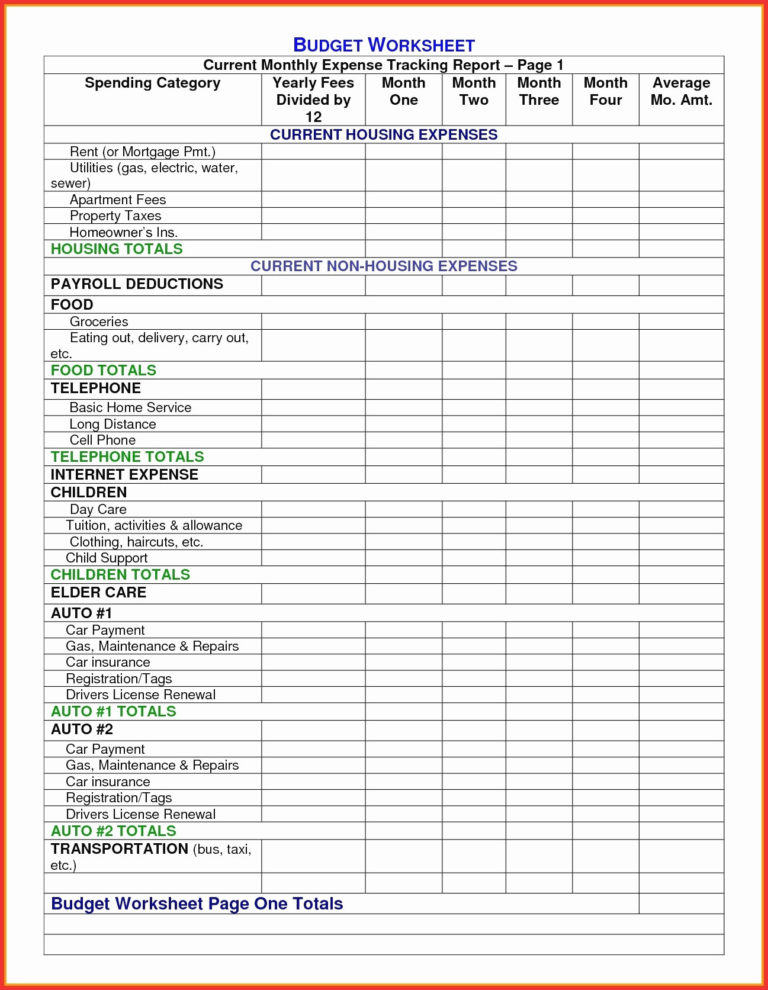

You can also download it, export it or print it out. With this form, you can track your mileage, fuel costs, and other expenses. Car truck expenses (personal vehicle) ! Web forms that you should file as a truck driver depends on your type of employment: Riviera finance november 10, 2022 no comments.

Owner Operator Expense Spreadsheet Google Spreadshee owner operator

Interest paid on business loans; $153.00 per $1,000) before adjustment on the front of your 1040 tax return); Web truck driver expenses worksheet. However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Web truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

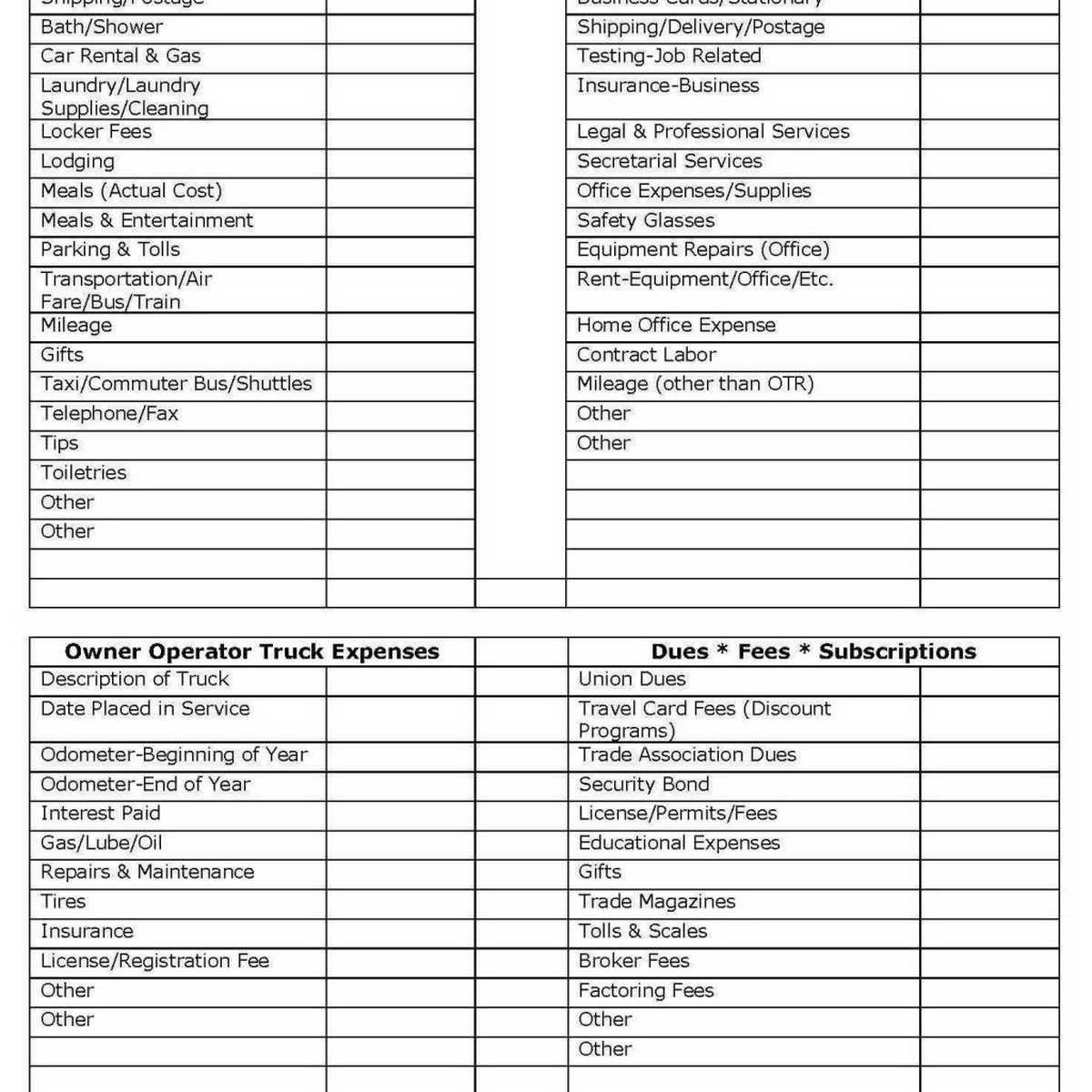

Keep track of what deductions you are taking advantage of. Web expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form: Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Edit your tax deduction worksheet for truck drivers online. Travel expenses,.

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable

Taxes and deductions that may be considered “ordinary and necessary” depends upon: Trucker’s income & expense worksheet; This means you need to keep accurate records of your deductions as well as your earnings. Schedule a:various medical expenses, charitable contributions, unreimbursed employee business expenses, etc. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will.

Truck Driver Expense Spreadsheet Then Owner Operator —

However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Select the document you want to sign and click upload. Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. You can also download it, export it or print it out. Web common tax deductions for owner operator truck.

33 Truck Driver Tax Deductions Worksheet Worksheet Project List

Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. Interest paid on business loans; Bonus depreciation allows companies to depreciate the full cost of a costly truck in one year, which helps business owners to invest in heavy vehicles for trucking business use. Web send 2020 truck driver tax deductions worksheet via email, link, or fax..

Free Owner Operator Expense Spreadsheet in Truck Driver Expenset

Some trucking companies might have some differences when it comes to truck driver tax deductions or tax breaks. It all depends on the type of business the trucking company is in and their vehicle operating expenses. Download 2023 per diem tracker Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find.

Truck Driver Expenses Worksheet ≡ Fill Out Printable PDF Forms Online

Web this truck driver expenses worksheet form can help make the process a little easier. However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. What the job is and.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Sales of equipment, machinery, land, buildings held for business use ! Kind of property date acquired date sold gross sales price expenses of sale original cost and ! Web trucker tax deduction worksheet our list of the most common truck driver.

Truck Driver Profit and Loss Statement Template Tagua

Web here is a list of some of the items you might be able to deduct: Sales of equipment, machinery, land, buildings held for business use ! Here’s a look at common deductions and business expenses truck drivers can claim on their taxes. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway.

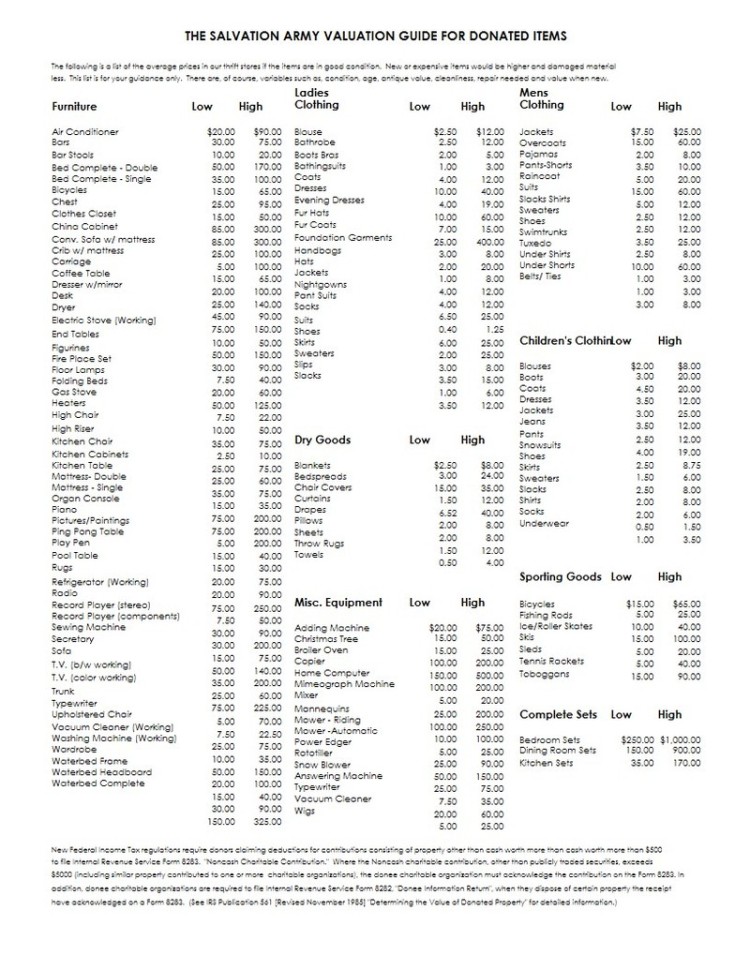

Bonus depreciation allows companies to depreciate the full cost of a costly truck in one year, which helps business owners to invest in heavy vehicles for trucking business use. Web most truck driver pay about $550 dollar for heavy highway use tax. Sales of equipment, machinery, land, buildings held for business use ! You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Trade association dues or subscriptions to trade magazines. Web expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form: Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. Web common tax deductions for owner operator truck drivers. With this form, you can track your mileage, fuel costs, and other expenses. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Edit your tax deduction worksheet for truck drivers online. Printing out a copy of this form and keeping it with your receipts can help. Car truck expenses (personal vehicle) ! Web here is a list of some of the items you might be able to deduct: Web forms that you should file as a truck driver depends on your type of employment: Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? Web truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax liability. Medical insurance premiums paid may be deductible! What the job is and what the expenses are for.

Type Text, Add Images, Blackout Confidential Details,.

Interest paid on business loans; Schedule a:various medical expenses, charitable contributions, unreimbursed employee business expenses, etc. Car truck expenses (personal vehicle) ! Web common tax deductions for owner operator truck drivers.

Web Trucker Tax Deduction Worksheet Our List Of The Most Common Truck Driver Tax Deductions Will Help You Find Out How You Can Save Money On Your Taxes!

This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married couples filing jointly or surviving spouses. Web according to new tax laws for truck drivers in 2023, truck driving companies have two options for a tax deduction for truck drivers: Web send 2020 truck driver tax deductions worksheet via email, link, or fax.

Web Here Is A List Of Some Of The Items You Might Be Able To Deduct:

Web expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form: Riviera finance november 10, 2022 no comments. Printing out a copy of this form and keeping it with your receipts can help. Travel expenses, if incurred while being away from your tax base.

Web Truck Driver Expenses Worksheet.

Edit your tax deduction worksheet for truck drivers online. It all depends on the type of business the trucking company is in and their vehicle operating expenses. Remember, you must provide receipts or other documentation. Select the document you want to sign and click upload.