Form 941 Excel Template - Fill & download for free get form download the form a comprehensive guide to editing the form 941 worksheet 1 excel below you can get an idea about how to edit and complete a form 941 worksheet 1 excel hasslefree. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. Learn more form 941 worksheet for 2022 Annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? Read the separate instructions before you complete form 941. You should potentially use worksheet 1 when claiming credits under the cares act and employee retention credit for the second quarter of 2020 and beyond. Use forms for the calendar year being balanced only. If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Employers need to complete the worksheets that correspond to the credits they claimed during the quarter.

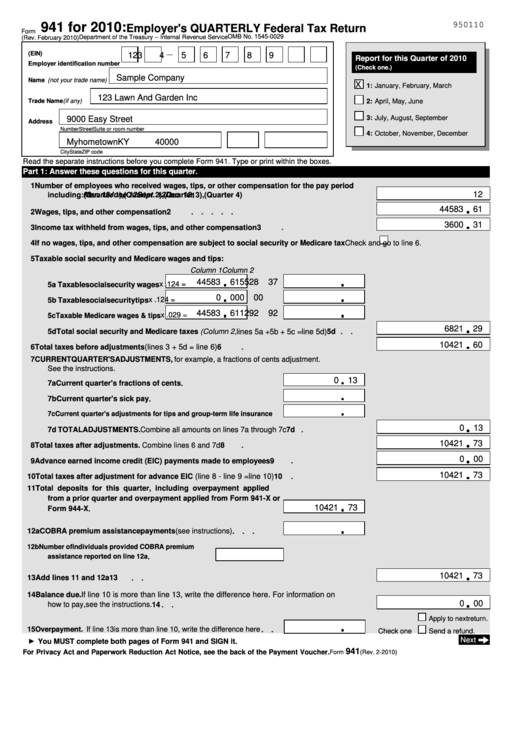

Download 2013 Form 941 for Free Page 2 FormTemplate

Numbers can be entered with or without hyphens (e.g. Web time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. What's new social security and medicare tax for 2023. Web download irs form 941 worksheet template for free free download irs form 941.

Form 941 Employers Quarterly Federal Tax Return, Schedule B (Form 941

Web download irs form 941 worksheet template for free free download irs form 941 worksheet template calculate your tax credits automatically download now irs updates: Use forms for the calendar year being balanced only. Current revision form 941 pdf instructions for form 941 ( print version. Get the form 941 excel template you require. Web the irs has released an.

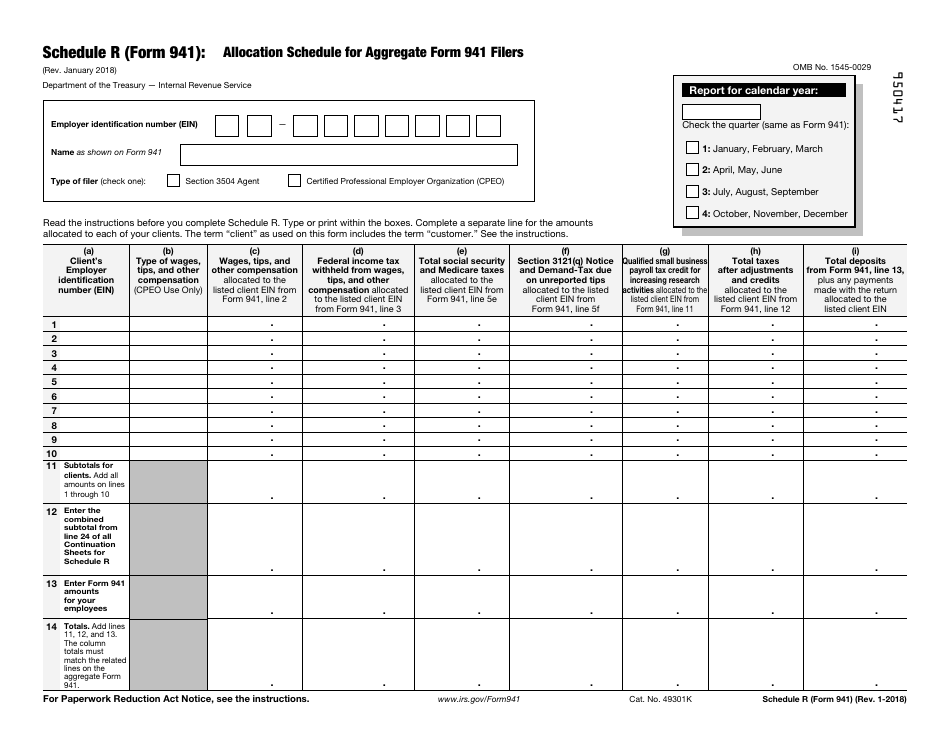

IRS Form 941 Schedule R Download Fillable PDF or Fill Online Allocation

Provide a copy of the amended form 941 payroll report used for erc to your tax preparer so they can adjust the deductible wages for the period on 2020 tax return. Current revision form 941 pdf instructions for form 941 ( print version. Read the separate instructions before you complete form 941. 001223333) will drop the leading zeroes. Annual amounts.

Irs form 941 Fillable How to Fill Out Tax form 941 Intro Video in 2020

Type or print within the boxes. If these forms are not in balance, penalties from the irs and/or ssa could result. Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Annual amounts from payroll records should match the total amounts reported on all forms 941.

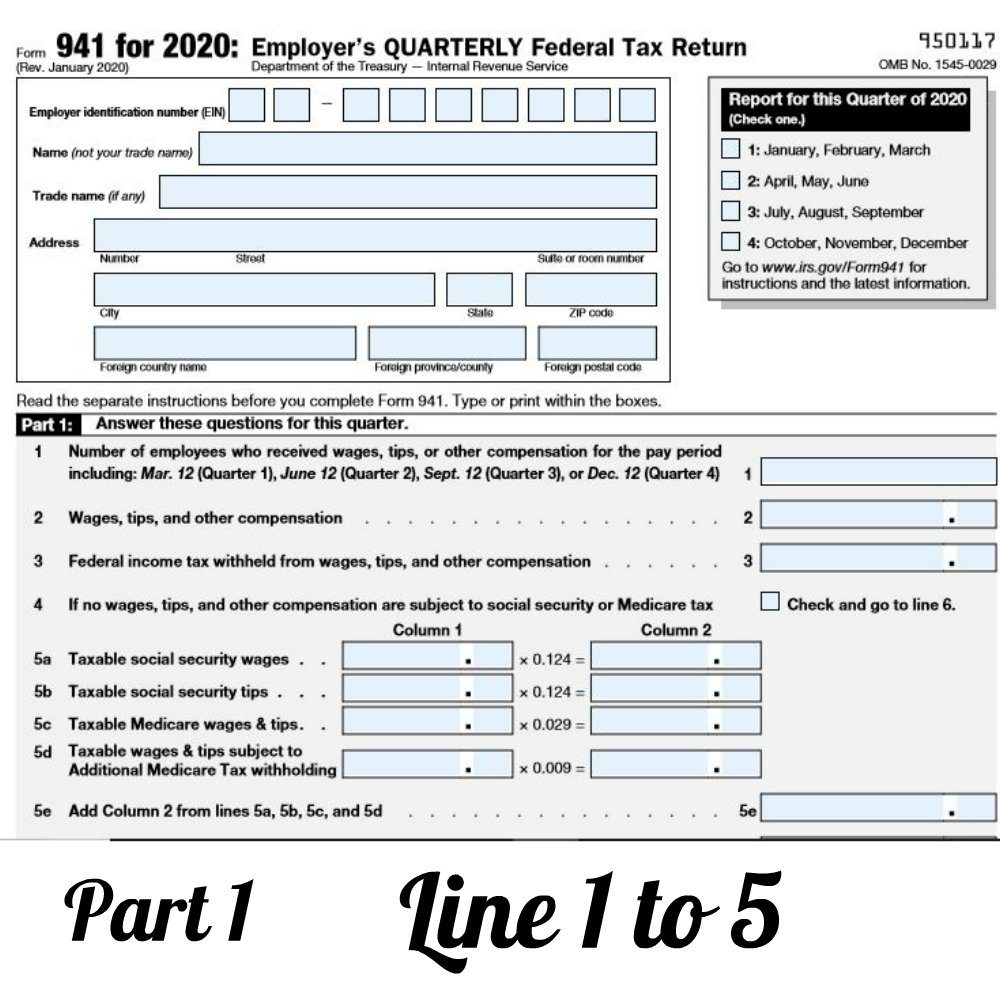

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

001223333) will drop the leading zeroes. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Worksheet 1 will help in determining the. I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941.

941 Worksheet 1 2020 Fillable Pdf

Type or print within the boxes. Use forms for the calendar year being balanced only. Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and. Fill & download for free get form download the form a comprehensive guide to editing the form 941 worksheet 1 excel below you can get an.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

You can follow the question or vote as. Current revision form 941 pdf instructions for form 941 ( print version. Web form 941 worksheet 1. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.

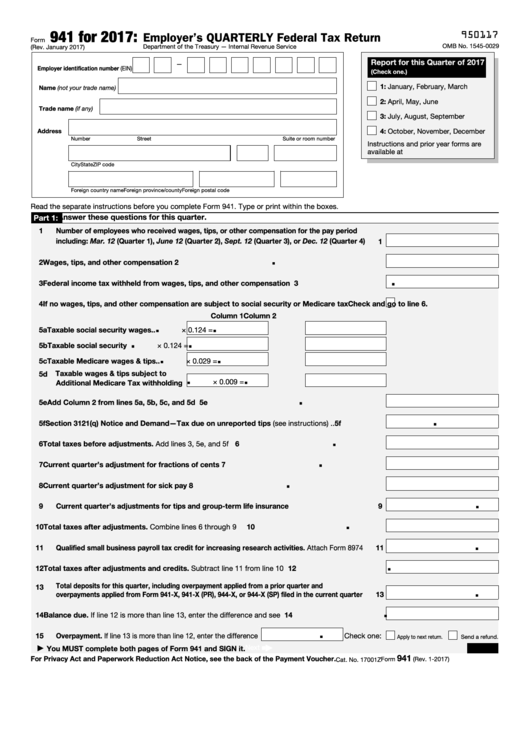

How to fill out IRS Form 941 2019 PDF Expert

Web form 941 worksheet 1. Fill & download for free get form download the form a comprehensive guide to editing the form 941 worksheet 1 excel below you can get an idea about how to edit and complete a form 941 worksheet 1 excel hasslefree. You can follow the question or vote as. You should potentially use worksheet 1 when.

How to Fill out IRS Form 941 Nina's Soap

Web to do this, highlight column a and then in your excel toolbar click format, then cells, text and then ok. Web time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Learn more form 941 worksheet for 2022 Thus, any employer who.

Download IRS Form 941 Worksheet Template for FREE

If these forms are not in balance, penalties from the irs and/or ssa could result. Provide a copy of the amended form 941 payroll report used for erc to your tax preparer so they can adjust the deductible wages for the period on 2020 tax return. Below is a summary of the new fields on the form and how accounting.

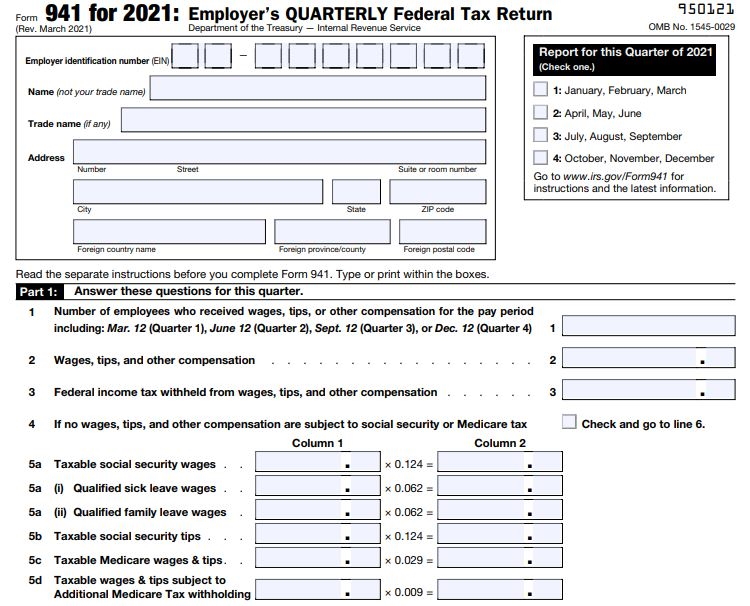

Annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Employers need to complete the worksheets that correspond to the credits they claimed during the quarter. Worksheet 1 will help in determining the. The formula will calculate the erc automatically and is equal to 50% of eligible wages determined in step 2. Share your form with others send 941 template via email, link, or fax. If changes in law require additional changes to form 941, the form and/or these instructions may be revised. You should potentially use worksheet 1 when claiming credits under the cares act and employee retention credit for the second quarter of 2020 and beyond. Web to do this, highlight column a and then in your excel toolbar click format, then cells, text and then ok. What's new social security and medicare tax for 2023. Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and. This worksheet helps employers calculate and report corrections to previously filed form 941, which is used for reporting federal income taxes, social security taxes, and. Prior revisions of form 941 are available at irs.gov/form941 (select the link for I have found many 941 pdf fillers but was wondering if anybody had an excel format version of the 941 in excel and the 941 b? It is important this is completed in advance, otherwise any entries made which start with zero (e.g. Type or print within the boxes. If you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Pay The Employer's Portion Of Social Security Or Medicare Tax.

We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. Prior revisions of form 941 are available at irs.gov/form941 (select the link for Web 941 irs excel template. Web to do this, highlight column a and then in your excel toolbar click format, then cells, text and then ok.

Type Or Print Within The Boxes.

Web form 941 worksheet 1 excel: Use forms for the calendar year being balanced only. Web form 941 worksheet 1. Provide a copy of the amended form 941 payroll report used for erc to your tax preparer so they can adjust the deductible wages for the period on 2020 tax return.

Fill In The Empty Fields;

Current revision form 941 pdf instructions for form 941 ( print version. Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web form 941 for 2023:

Worksheet 1 Will Help In Determining The.

Web time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Web the irs has released an updated version of form 941 for the 2nd through 4th quarters of 2020, the 1st quarter 2021, the 2nd through 4th quarters of 2021, and the 1st quarter of 2022 and later. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Get the form 941 excel template you require.