Asc 842 Lease Accounting Excel Template - Manage all your business expenses in one place with quickbooks®. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to the balance sheet. Explore the #1 accounting software for small businesses. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check into compliance with this standard. Ad track everything in one place. Download the free asc 842 lease classification template to ensure you are in the know! As the name indicates, this standard has been in existence since 2016. Web larson lease accounting template asc 842.

ASC 842 Excel Template Download

Finance lease identification under asc 842 transference of title/ownership to the lessee purchase option lease term for major part of the remaining economic life of the asset present value represents “substantially all” of the fair value of. Lease classification template a streamlined & simplified lease classification process for lessees lease classification test Under asc 842, for leases with terms of.

Slide 1

Explore the #1 accounting software for small businesses. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). They will significantly affect organizations having. Value of the right of use asset divided by total remaining useful life days. Ad asc 842 brought significant changes to.

Excel Solution

Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Click the link to download a template for asc 842. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations.

Lease Modification Accounting for ASC 842 Operating to Operating

Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Adopting asc 842 a proactive approach to adoption can be beneficial. Manage all your business expenses in one place with quickbooks®. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to.

ASC 842 Lease Accounting Finance lease, Budget planning, Public company

Asc 842 lease classification test use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Explore the #1 accounting software for small businesses. It specifically does not apply to the following nondepreciable assets accounted for under other fasb. Finance lease identification under asc 842 transference of title/ownership to the lessee purchase.

Favorite Asc 842 Excel Template Google Spreadsheet Personal Commission

It specifically does not apply to the following nondepreciable assets accounted for under other fasb. Manage all your business expenses in one place with quickbooks®. 87 (gasb 87), change the financial reporting requirements of organizations that enter into leasing transactions or other contracts for assets such as real estate, vehicles and equipment. Value of the right of use asset divided.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

They will significantly affect organizations having. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to the balance sheet. Explore the #1 accounting software for small businesses. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check into.

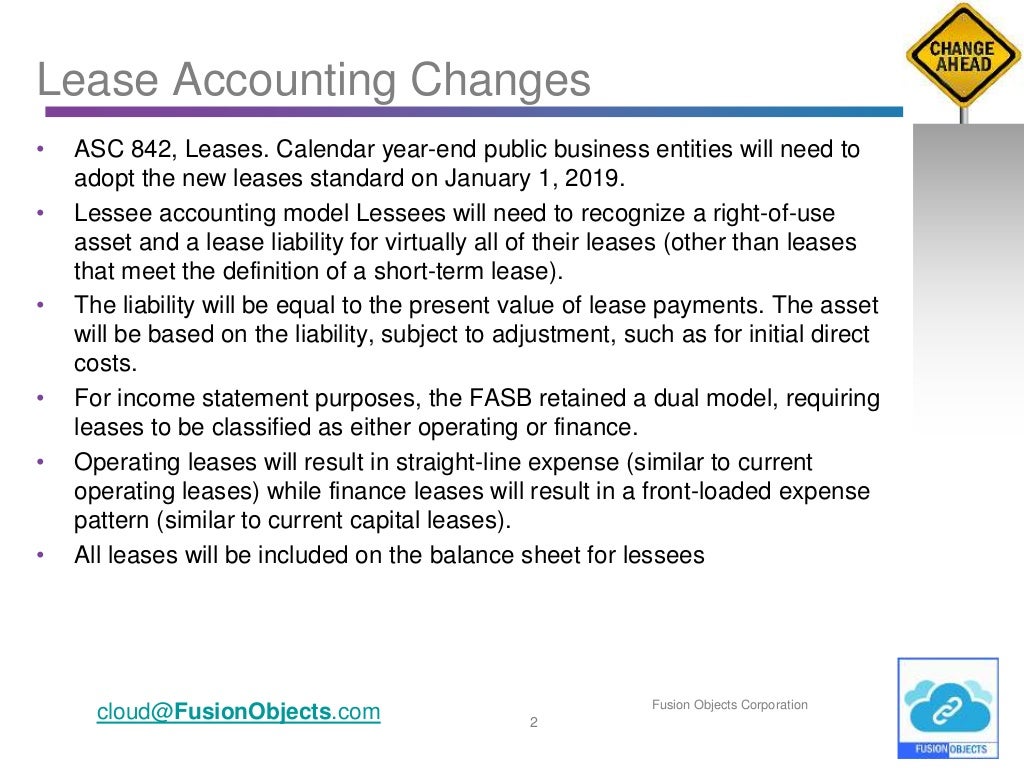

Asc 842, leases overhaul of fas13 lease accounting

Download the free asc 842 lease classification template to ensure you are in the know! Web what is asc 842? The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be. Lease classification template a streamlined & simplified lease classification process for lessees lease classification test Value of the right of use asset divided by.

A Quick Guide For Smooth Transition to New Lease Accounting Standard

The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be. Ad asc 842 brought significant changes to lease accounting standards. Adopting asc 842 a proactive approach to adoption can be beneficial. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Operating lease treatment under asc 842 vs.

Asc 842 Operating Lease Excel Template templates.iesanfelipe.edu.pe

Explore the #1 accounting software for small businesses. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to the balance sheet. They will significantly affect organizations having. Web asc 842 includes.

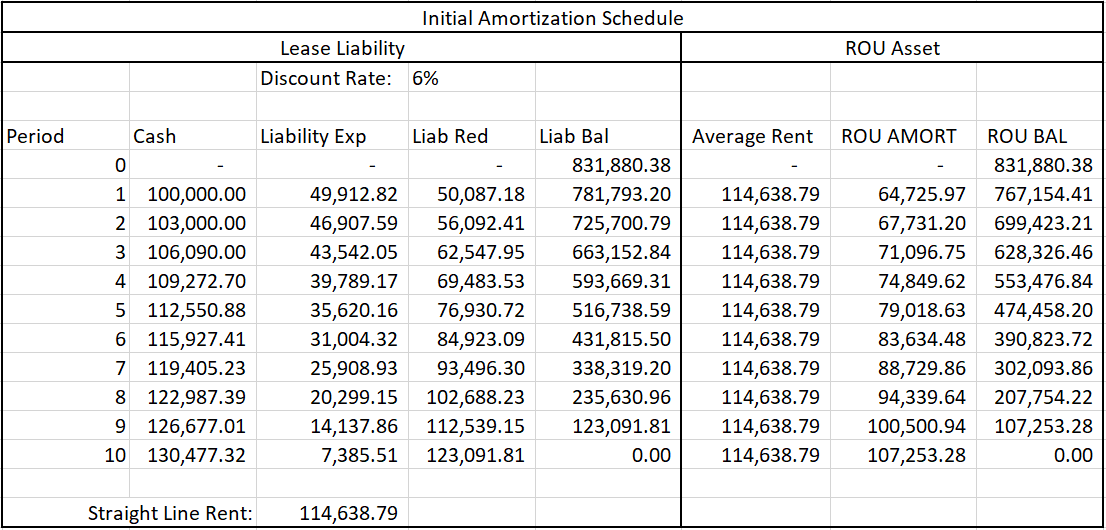

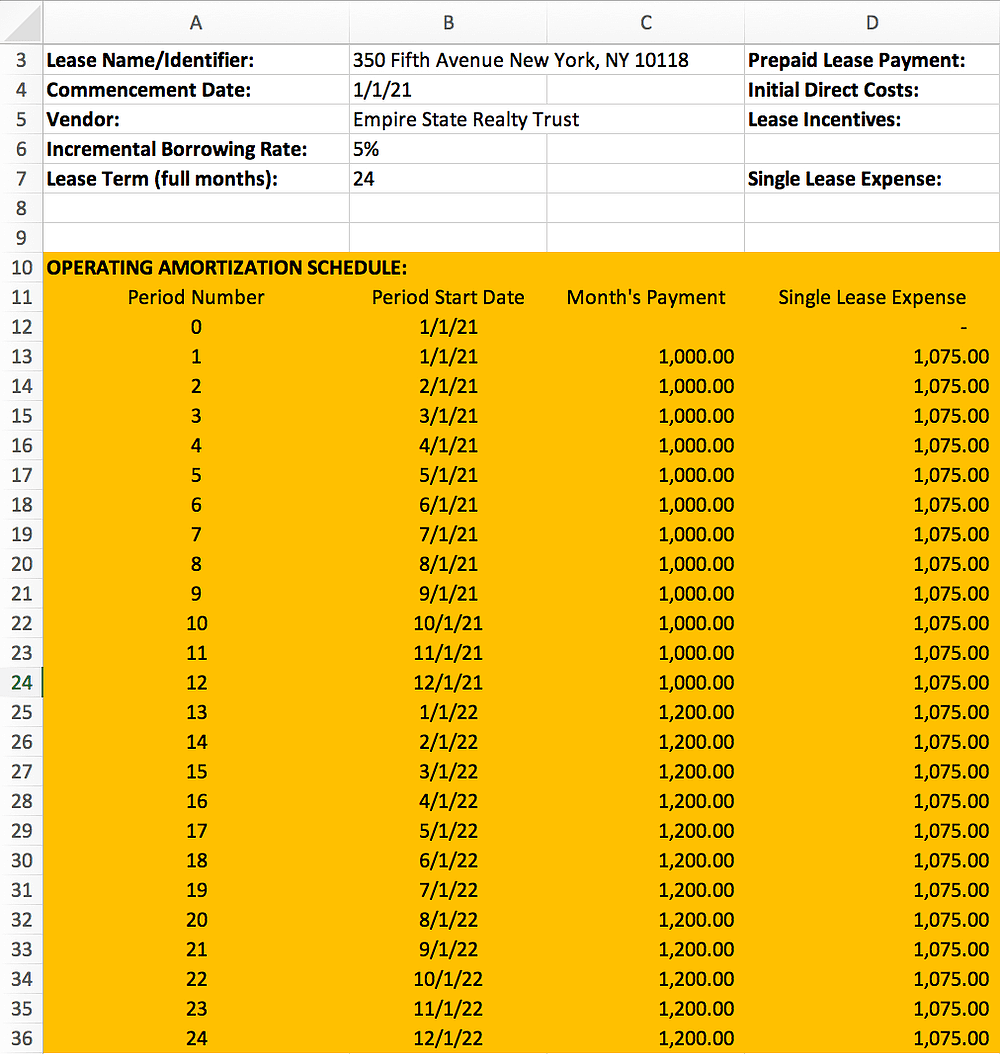

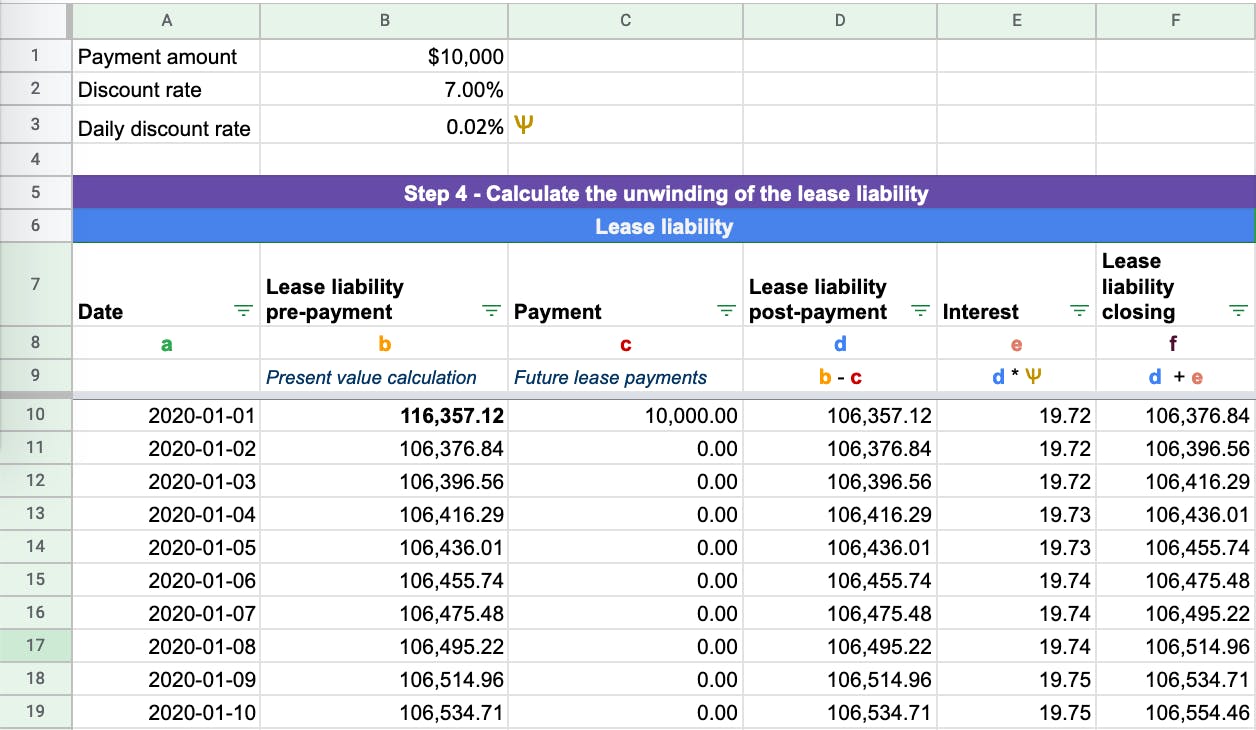

Manage all your business expenses in one place with quickbooks®. The lease liability we’re going to calculate is based on the following terms: Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. As the name indicates, this standard has been in existence since 2016. $10,000 payments at the beginning of each year; Explore the #1 accounting software for small businesses. Web accounting standards update (asu) no. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. Click the link to download a template for asc 842. Web with a finance lease under asc 842, the calculation methodology to calculate the amortization rate post modification follows the same methodology at initial recognition. Web what is asc 842? Under asc 842, for leases with terms of 12 months or less, lessees can elect to not recognize. 87 (gasb 87), change the financial reporting requirements of organizations that enter into leasing transactions or other contracts for assets such as real estate, vehicles and equipment. Ad track everything in one place. It specifically does not apply to the following nondepreciable assets accounted for under other fasb. Operating lease treatment under asc 842 vs. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to the balance sheet. Download the free asc 842 lease classification template to ensure you are in the know! Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases. Lease classification template a streamlined & simplified lease classification process for lessees lease classification test

Web Download Our Free Asc 842 Lease Accounting Calculator And Calculate The Accounting Impact Of Leases Under New Lease Accounting Standard Us Gaap (Topic 842).

Download the free asc 842 lease classification template to ensure you are in the know! Asc 842 lease classification template Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases. 87 (gasb 87), change the financial reporting requirements of organizations that enter into leasing transactions or other contracts for assets such as real estate, vehicles and equipment.

Explore The #1 Accounting Software For Small Businesses.

It specifically does not apply to the following nondepreciable assets accounted for under other fasb. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check into compliance with this standard. Finance lease identification under asc 842 transference of title/ownership to the lessee purchase option lease term for major part of the remaining economic life of the asset present value represents “substantially all” of the fair value of. Adopting asc 842 a proactive approach to adoption can be beneficial.

Download The Free Asc 842 Lease Classification Template To Ensure You Are In The Know!

Under asc 842, for leases with terms of 12 months or less, lessees can elect to not recognize. As a result the calculation will be $28,546.45 / 77 = $370.73. The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be. As the name indicates, this standard has been in existence since 2016.

The Lease Liability We’re Going To Calculate Is Based On The Following Terms:

They will significantly affect organizations having. Operating lease treatment under asc 842 vs. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to the balance sheet. Web larson lease accounting template asc 842.