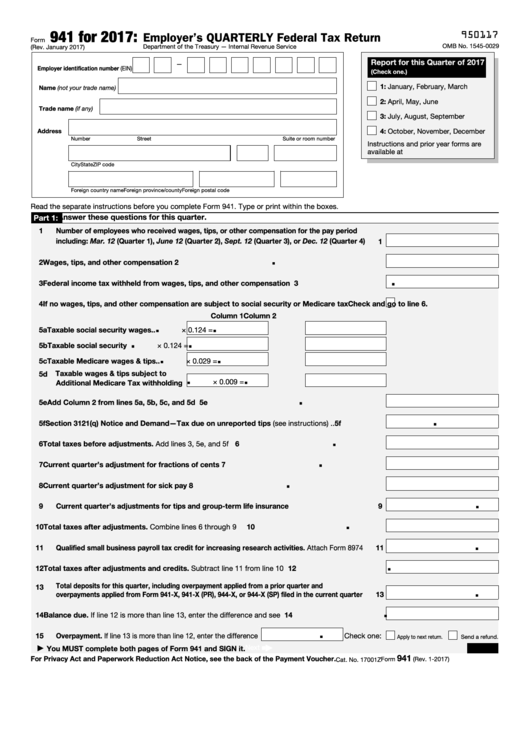

941 Reconciliation Template Excel - Does my general ledger match my payroll expenses? Fill in the empty fields; Select the ‘open’ option 3. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Engaged parties names, places of residence and phone. The goal is to confirm that the numbers. Thus, any employer who files the quarterly. Proceed until the excel template appears a. Web ðï ࡱ á> þÿ 1. This worksheet does not have to be.

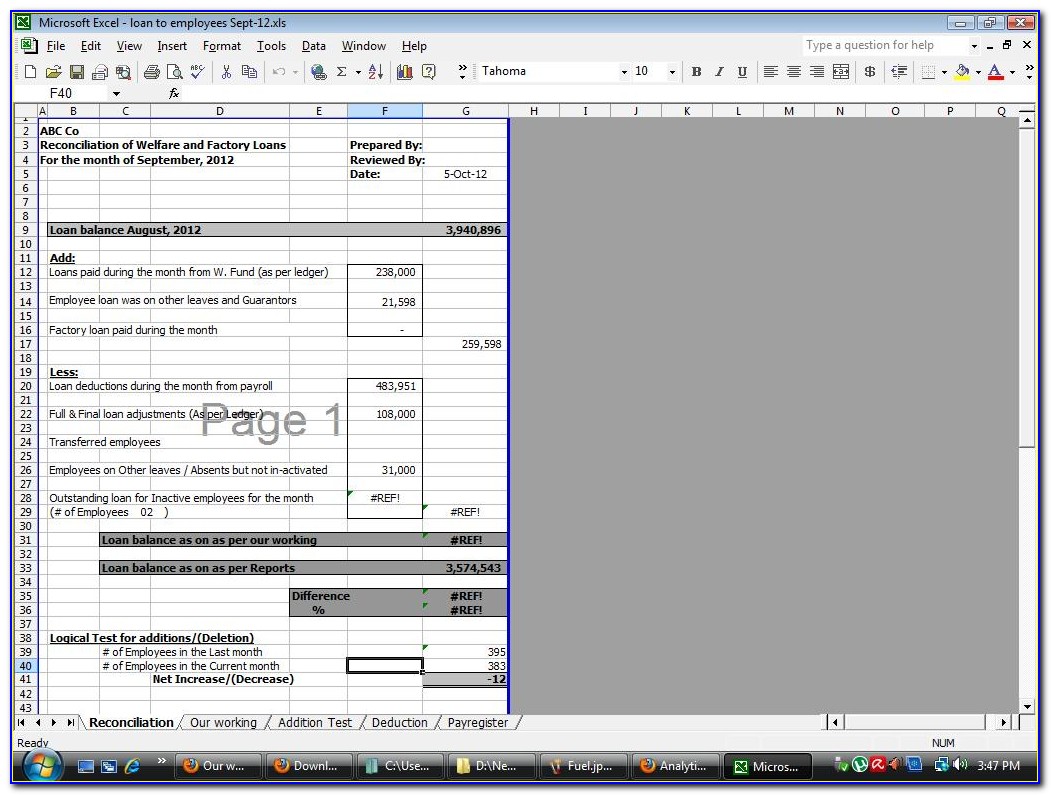

Payroll Reconciliation Excel Template Uk

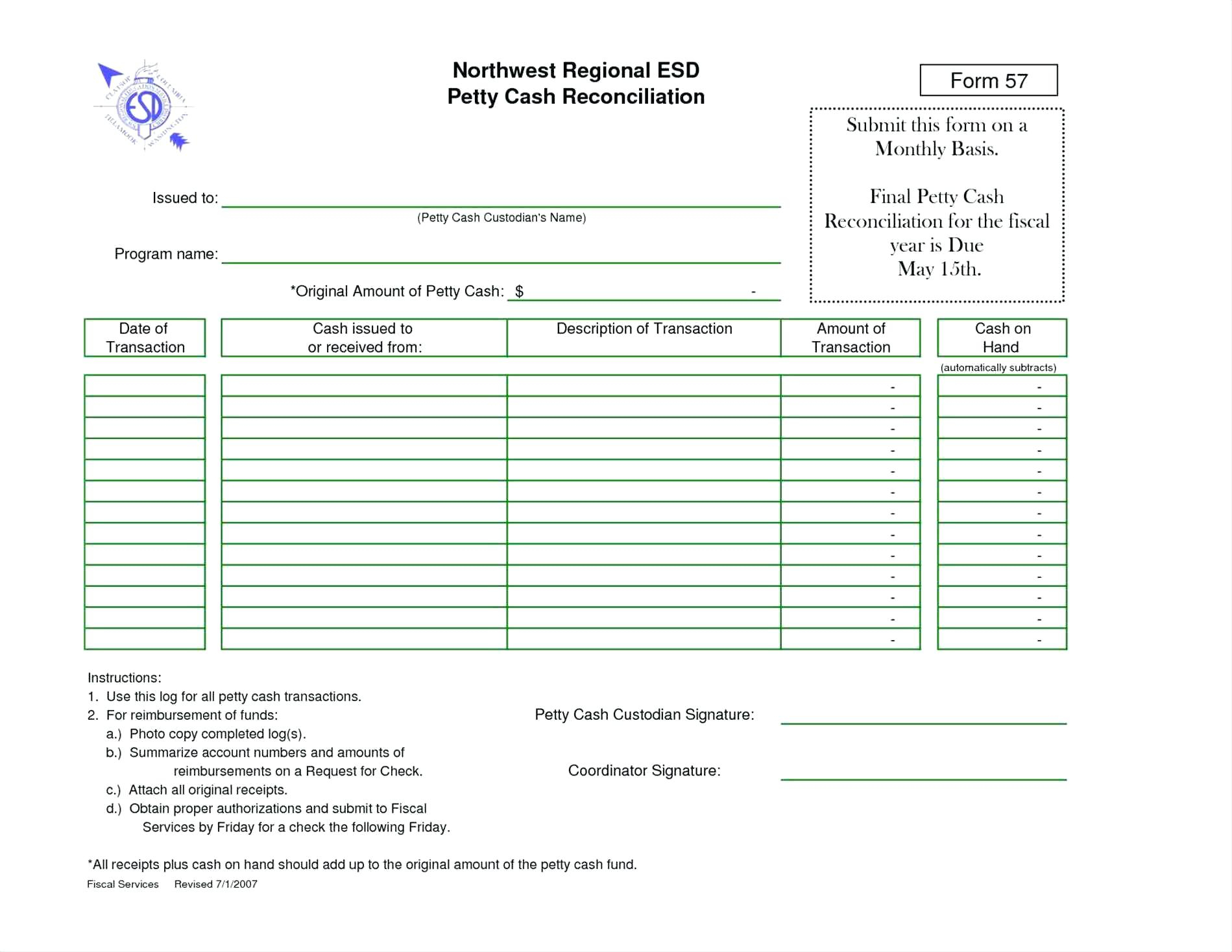

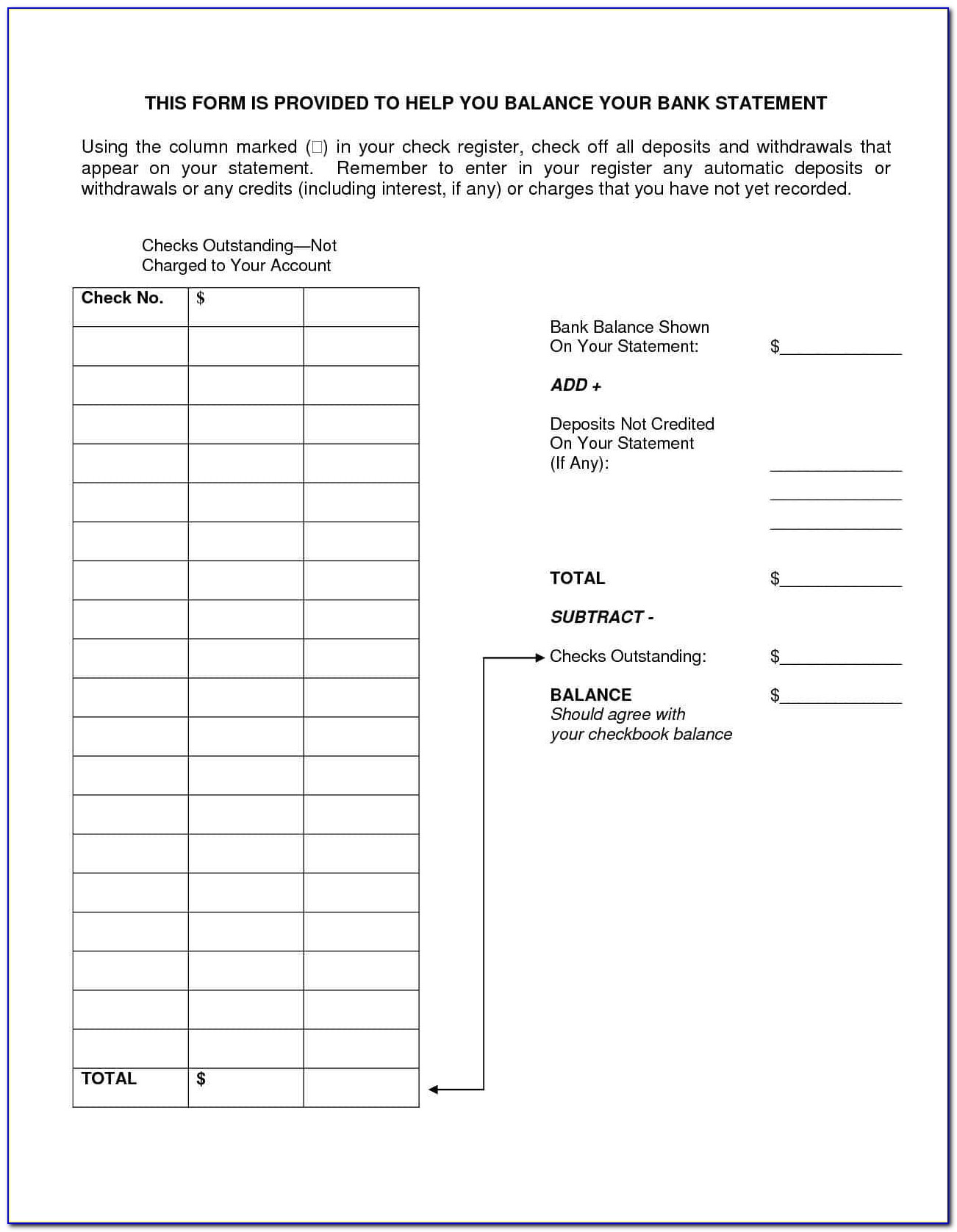

Proceed until the excel template appears a. The goal is to confirm that the numbers. Use on any account, petty cash, ledger, or. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Compare those figures with the totals reported on all four 941s for the year.

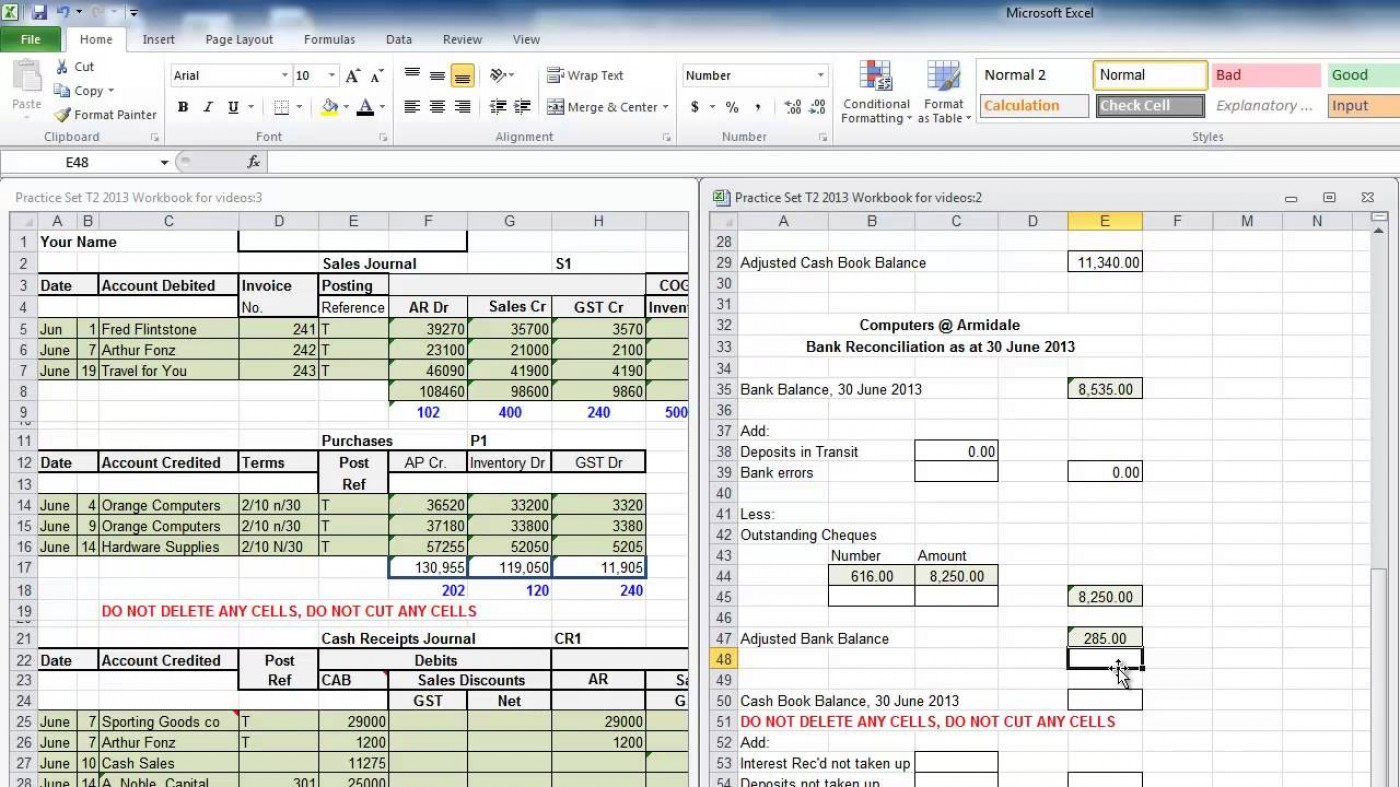

Bank Reconciliation Excel Spreadsheet —

Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. Make sure the amounts reported on. Compare those figures with the totals reported on all four 941s for the year. Type or print within the boxes. You must complete all three.

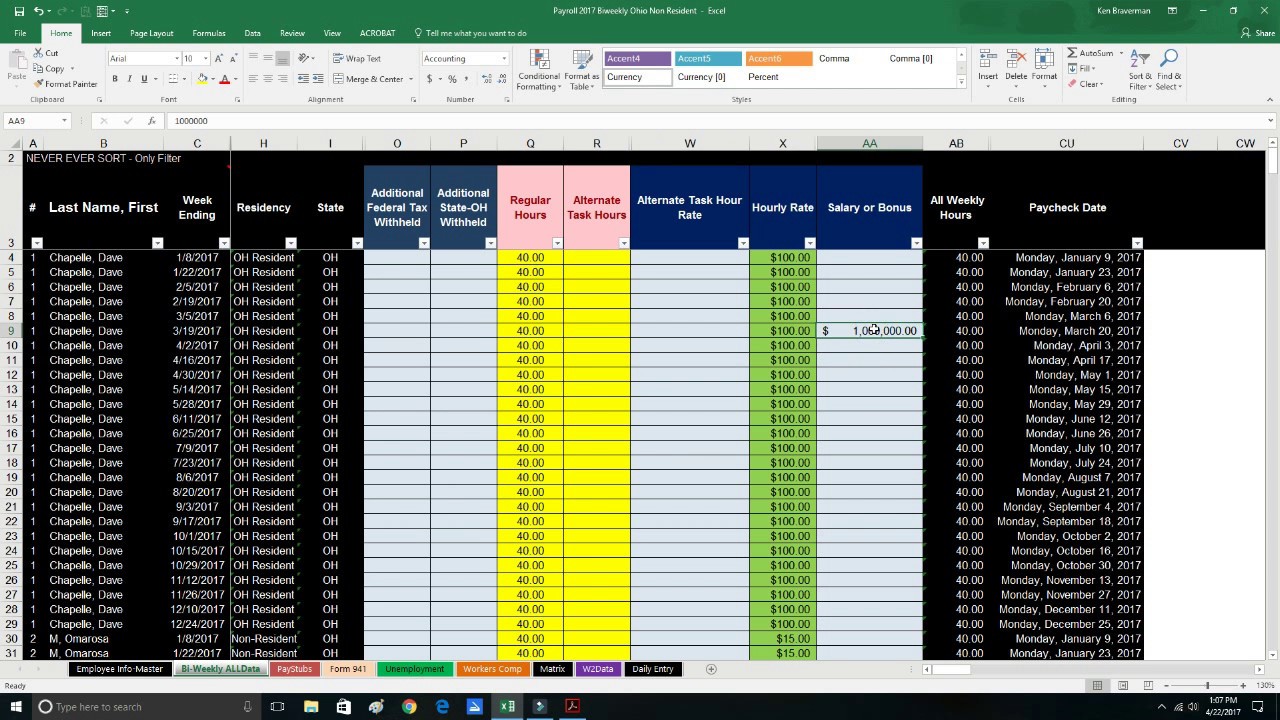

How to File Quarterly Form 941 Payroll in Excel 2017 YouTube

You must complete all five pages. You must complete all three. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Type or print within the boxes.

Inventory Reconciliation Format In Excel Excel Templates

Engaged parties names, places of residence and phone. Web refer to sample excel reconciliation template. Web form 941 worksheet for 2022. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Thus, any employer who files the quarterly.

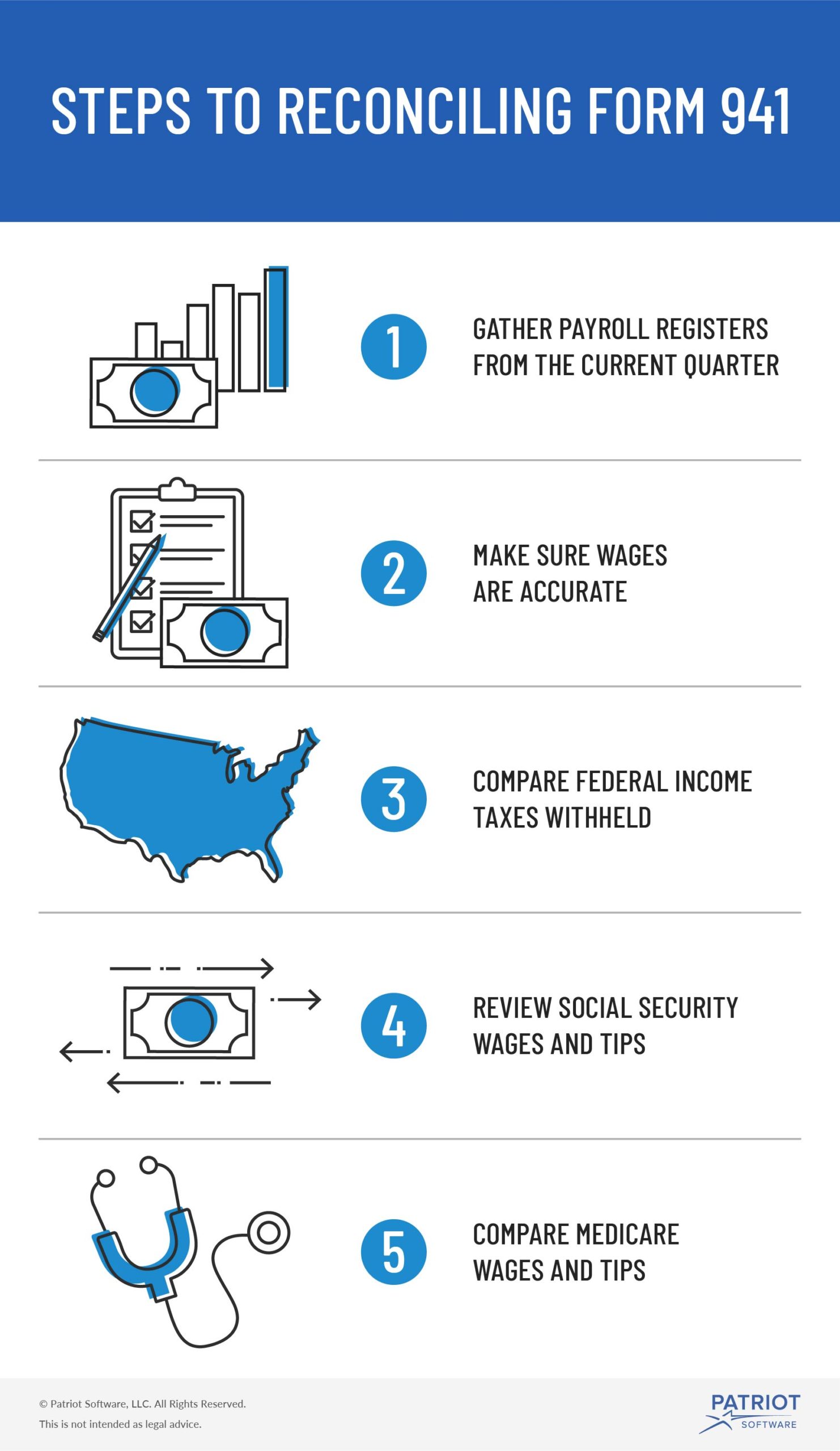

What to Know About Form 941 Reconciliation Steps, Due Dates, & More

Select the ‘open’ option 3. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Your total payroll expenses must match what you’ve posted in your general ledger. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. From the “enter tax.

General Ledger Account Reconciliation Template —

Proceed until the excel template appears a. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Compare those figures with the totals reported on all four 941s for the year. The goal is to confirm that the numbers. Web use the march.

Daily Cash Reconciliation Excel Template

Web refer to sample excel reconciliation template. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Engaged parties names, places of residence and phone. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order..

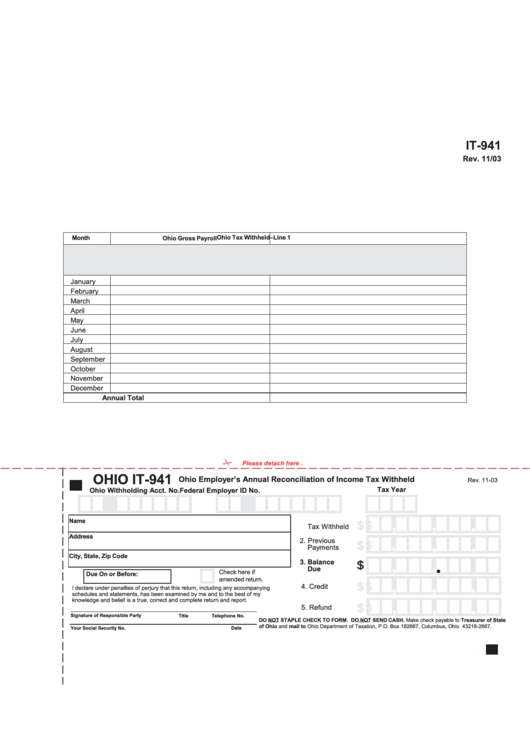

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

Web form 941 worksheet for 2022. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web refer to sample excel reconciliation template. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Your total payroll expenses must match what you’ve posted.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Don't use an earlier revision to report taxes for 2023. Compare those figures with the totals reported on all four 941s for the year. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web ðï ࡱ á> þÿ 1. Web get the.

Bank Reconciliation Excel Spreadsheet for Excel Spreadsheet For

Does my general ledger match my payroll expenses? Engaged parties names, places of residence and phone. Run a report that shows annual payroll amounts. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Your total payroll expenses must match what you’ve posted in your general ledger.

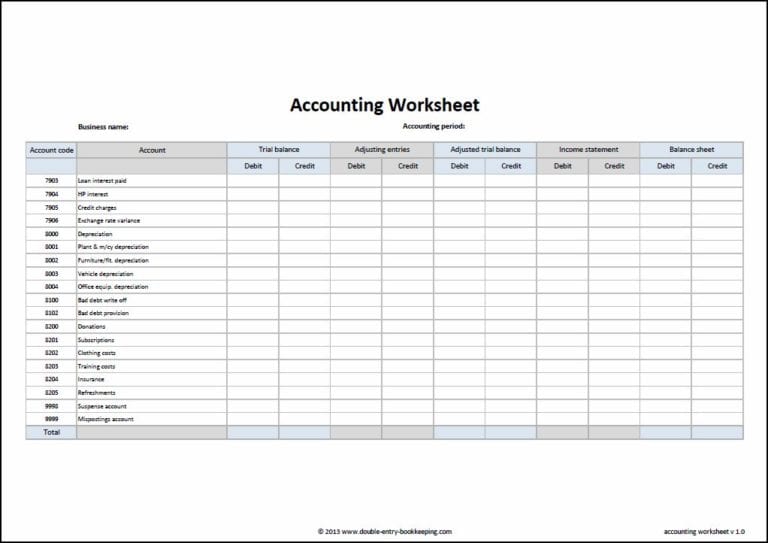

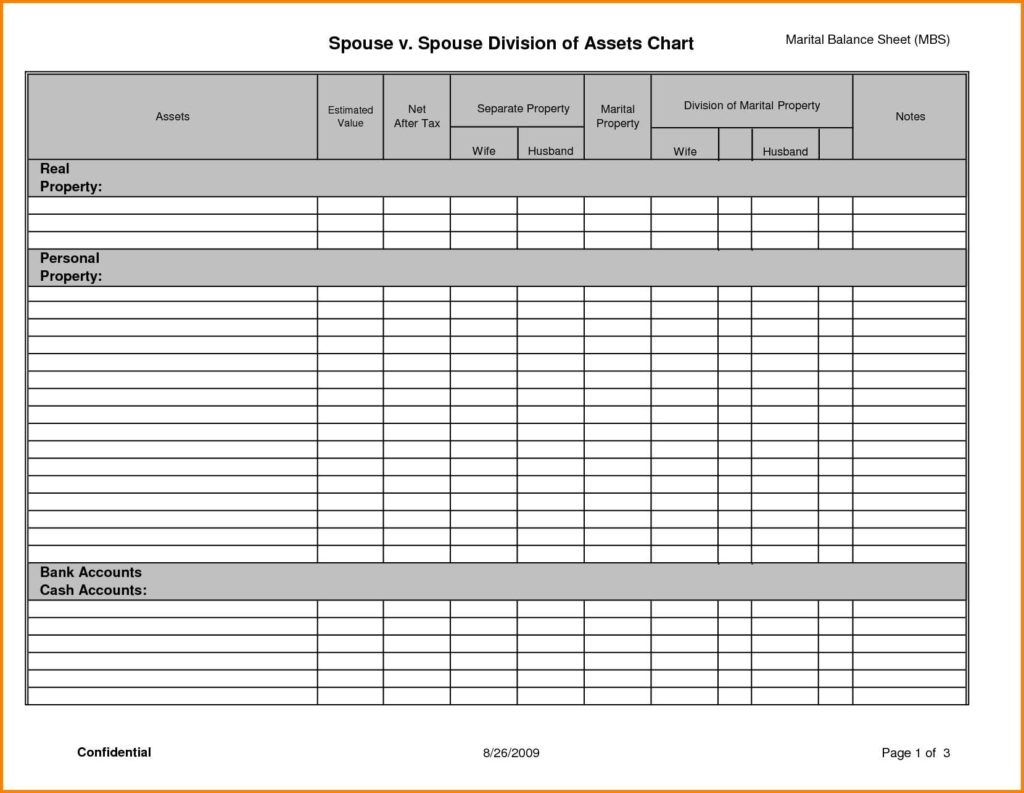

From the “enter tax return” portal page, click the ri bulk 941 upload template hyperlink 2. Web get the form 941 excel template you require. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. You must complete all five pages. Compare those figures with the totals reported on all four 941s for the year. If these forms are not in balance, penalties from the irs and/or ssa could result. Type or print within the boxes. This worksheet does not have to be. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Make sure the amounts reported on. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Does my general ledger match my payroll expenses? Don't use an earlier revision to report taxes for 2023. Document the following items on the reconciliation spreadsheet: Run a report that shows annual payroll amounts. Proceed until the excel template appears a. Web ðï ࡱ á> þÿ 1. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web form 941 worksheet for 2022.

Web Use The March 2023 Revision Of Form 941 To Report Taxes For The First Quarter Of 2023;

The goal is to confirm that the numbers. Document the following items on the reconciliation spreadsheet: Engaged parties names, places of residence and phone. Does my general ledger match my payroll expenses?

You Must Complete All Five Pages.

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. You must complete all three.

Make Sure You Retain Your Reconciliation Information.

At this time, the irs. Run a report that shows annual payroll amounts. Don't use an earlier revision to report taxes for 2023. Use on any account, petty cash, ledger, or.

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

From the “enter tax return” portal page, click the ri bulk 941 upload template hyperlink 2. Your total payroll expenses must match what you’ve posted in your general ledger. Web ðï ࡱ á> þÿ 1. Web refer to sample excel reconciliation template.