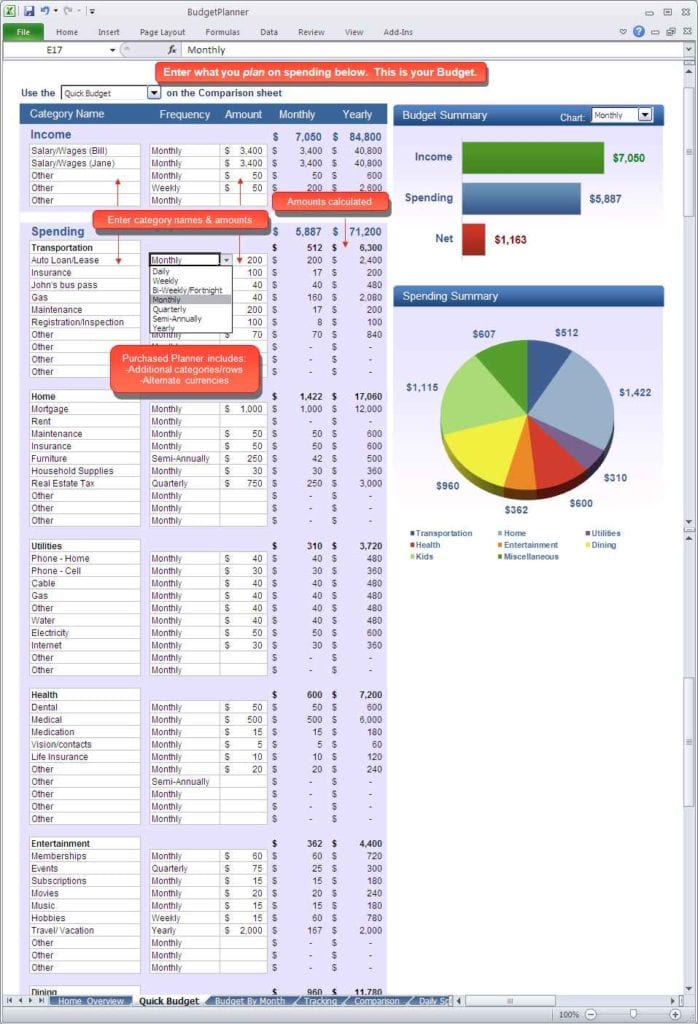

50/30/20 Budget Template Excel - Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Split your income between the 3 categories; Web 50/30/20 budget excel spreadsheet template. Figure out your total monthly income; Calculate monthly income step 02: Insert chart to visualize easily free template:. Web it sounds harder than it is. How do you pay off debt with a 50 / 20 / 30 budget? 50% for needs, 30% for wants, and also 20% for savings. $720 (401k and hsa) total income:

503020 Budgeting LAOBING KAISUO

Determine surplus or shortage step 06: Follow along for a quick budget example. Compare actual expenses with the ideal budget step 05: Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Split your income between the 3.

Free 50/30/20 Budget Calculator for Your Foundation Template

50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Determine surplus or shortage step 06: Adjust your actual spending to fit; What budget apps work with the 50 / 30 /. $720 (401k and hsa) total income:

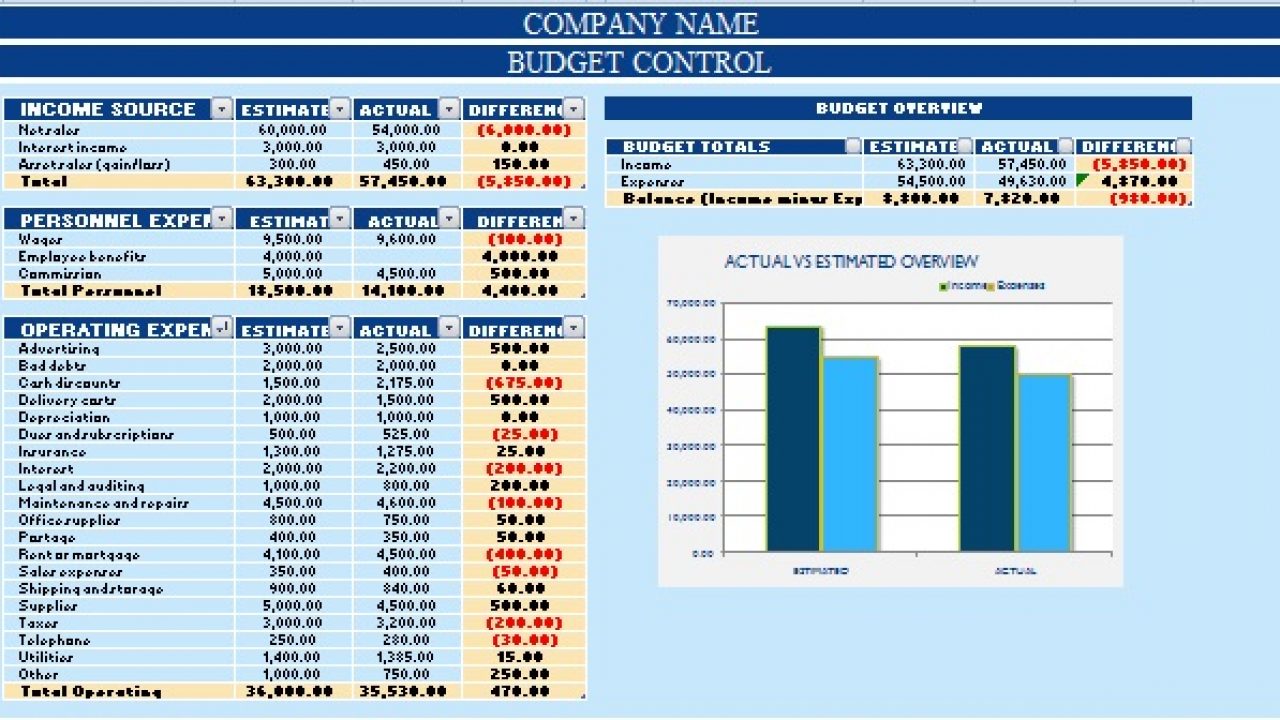

Marketing Communications Budget Template

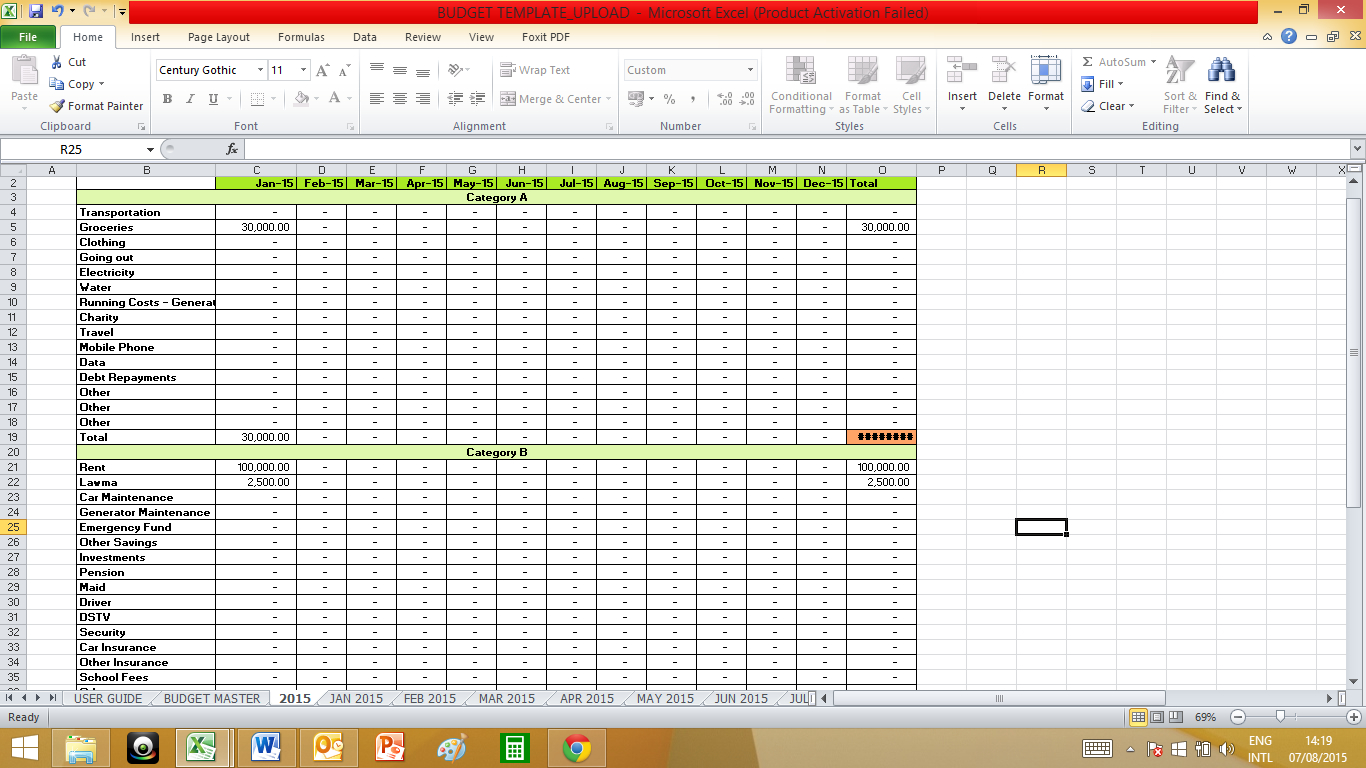

Adjust your actual spending to fit; And then make three columns: What budget apps work with the 50 / 30 /. Web 50/30/20 budget excel spreadsheet template. Split your income between the 3 categories;

50 30 20 Budget Excel Spreadsheet with regard to Template Budget

Web it sounds harder than it is. Who is this budget method for? What budget apps work with the 50 / 30 /. Web what is the 50 30 20 rule? Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796.

50 30 20 Budget Spreadsheet Template Google Spreadshee 50 30 20 budget

Web 50/30/20 budget excel spreadsheet template. Adjust your actual spending to fit; What budget apps work with the 50 / 30 /. Needs (50%), wants (30%) and savings (20%). Compare actual expenses with the ideal budget step 05:

50 30 20 Budget Spreadsheet Template throughout 50 30 20 Budget

Split your income between the 3 categories; Calculate monthly income step 02: Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Who is this budget method for? Web 50/30/20 budget excel spreadsheet template.

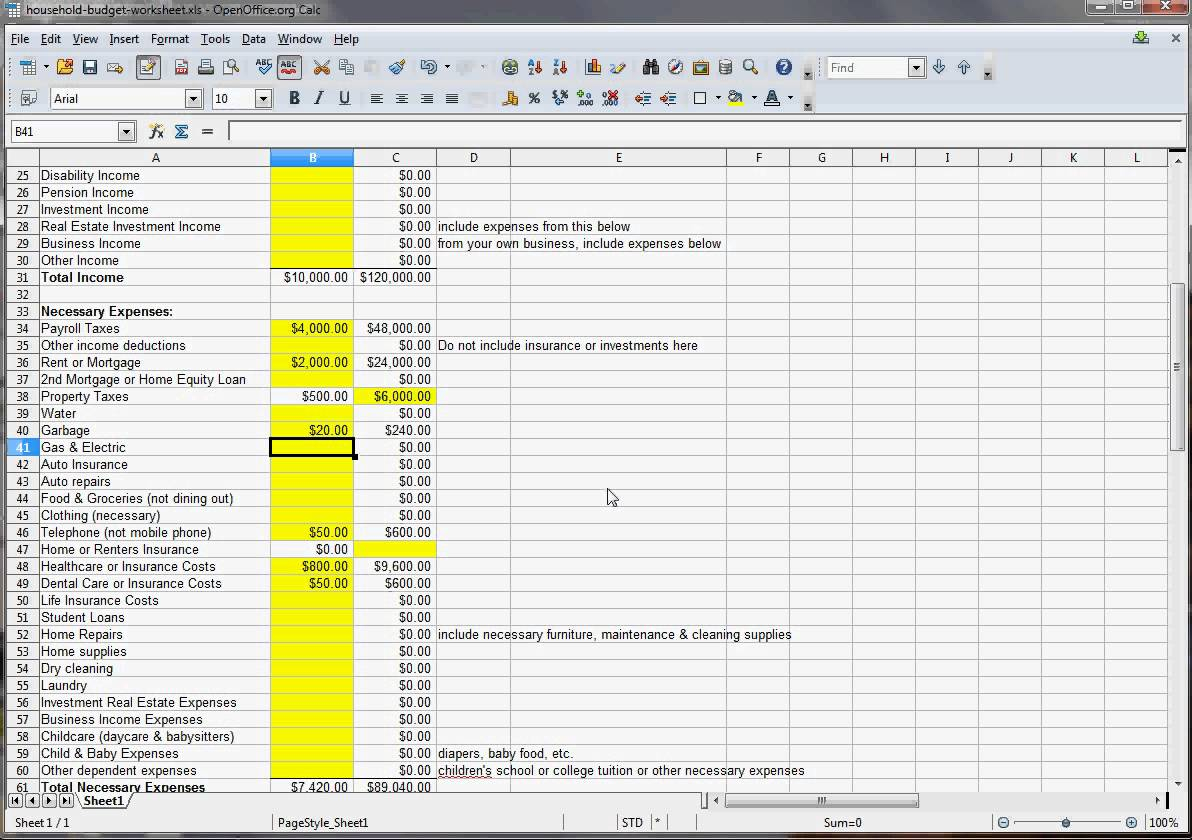

dave ramsey budget spreadsheet excel free —

The 50% needs category is for all your monthly essentials. Adjust your actual spending to fit; Split your income between the 3 categories; Web percentages for your budget. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward.

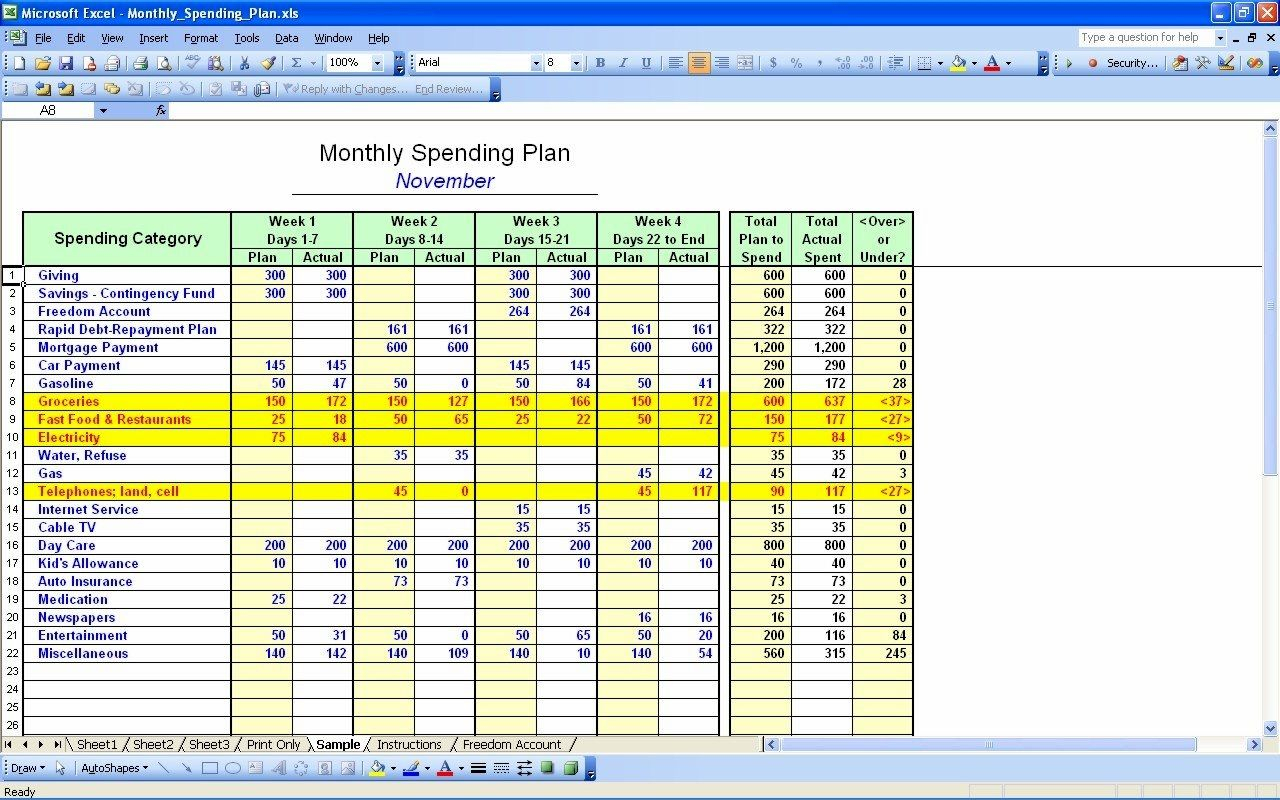

Budget Vs Actual Excel Template For Your Needs

The 50% needs category is for all your monthly essentials. $720 (401k and hsa) total income: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Web to start making your budget, you have to go to the source of it all: Split your income between the 3 categories;

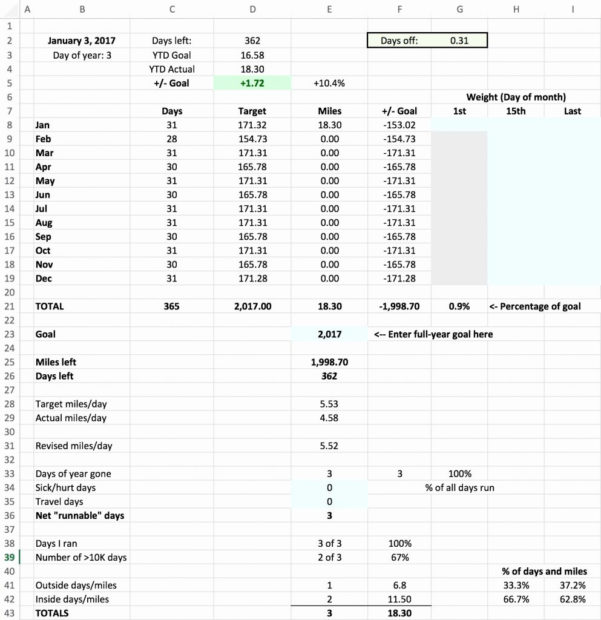

Student Budget Planner Spreadsheet —

Web it sounds harder than it is. Web percentages for your budget. How to set up a 50 / 30 / 20 budget. 50% for needs, 30% for wants, and also 20% for savings. Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796.

50 30 20 Budget Excel Spreadsheet —

And then make three columns: Follow along for a quick budget example. Needs (50%), wants (30%) and savings (20%). Determine surplus or shortage step 06: 50% for needs, 30% for wants, and also 20% for savings.

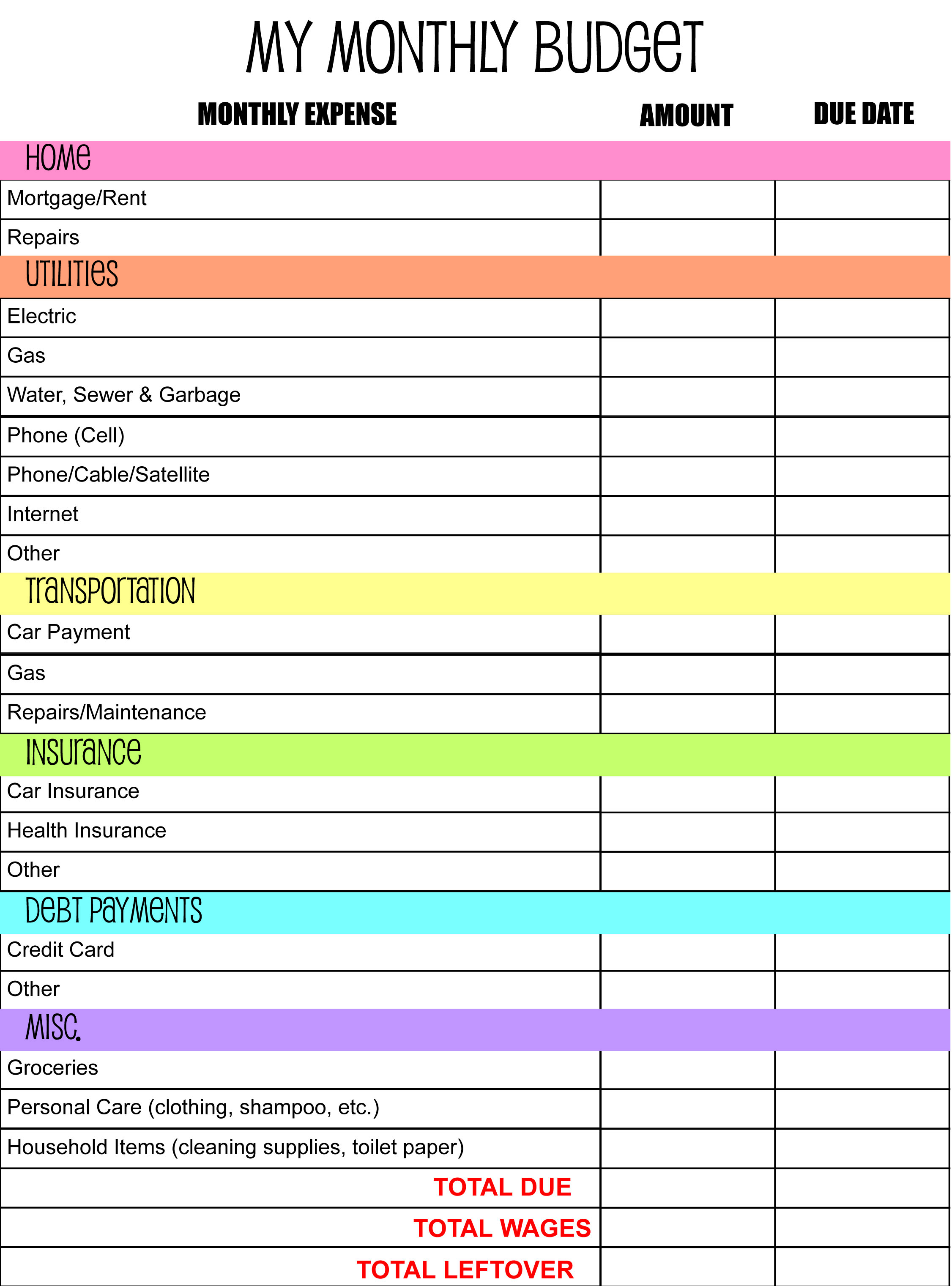

Split your income between the 3 categories; Adjust your actual spending to fit; Determine surplus or shortage step 06: Needs (50%), wants (30%) and savings (20%). Follow along for a quick budget example. Insert chart to visualize easily free template:. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. $720 (401k and hsa) total income: Web to start making your budget, you have to go to the source of it all: Figure out your total monthly income; How to set up a 50 / 30 / 20 budget. Web what is the 50 30 20 rule? Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Web percentages for your budget. Who is this budget method for? Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. If this budget sheet isn’t right for you, try another tool. 50% for needs, 30% for wants, and also 20% for savings. Web 50/30/20 budget excel spreadsheet template.

Calculate Monthly Income Step 02:

And then make three columns: How do you pay off debt with a 50 / 20 / 30 budget? Web 50/30/20 budget excel spreadsheet template. 50% for needs, 30% for wants, and also 20% for savings.

Web To Start Making Your Budget, You Have To Go To The Source Of It All:

Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Compute expenses in 3 different categories step 04: Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide.

Determine Surplus Or Shortage Step 06:

Follow along for a quick budget example. Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). What budget apps work with the 50 / 30 /. $720 (401k and hsa) total income:

If This Budget Sheet Isn’t Right For You, Try Another Tool.

Compare actual expenses with the ideal budget step 05: Web percentages for your budget. Split your income between the 3 categories; Needs (50%), wants (30%) and savings (20%).